Meeting Global Demand for Health IT Services

To propel its growth in Virginia, Harris Healthcare is forging partnerships internationally.

“A big part of our strategy is to grow in our current international markets, but also expand into new markets,” said Jeremy Trabucco, executive vice president at Harris Healthcare, based in Herndon.

By drumming up demand for its products internationally, Harris Healthcare hopes to not only grow its revenues but also create new jobs in Virginia, Trabucco said. The organization is a business unit of Ottawa, Ontario-based Harris Computer, which is a subsidiary of Constellation Software, a $20 billion publicly traded company on the Toronto stock exchange.

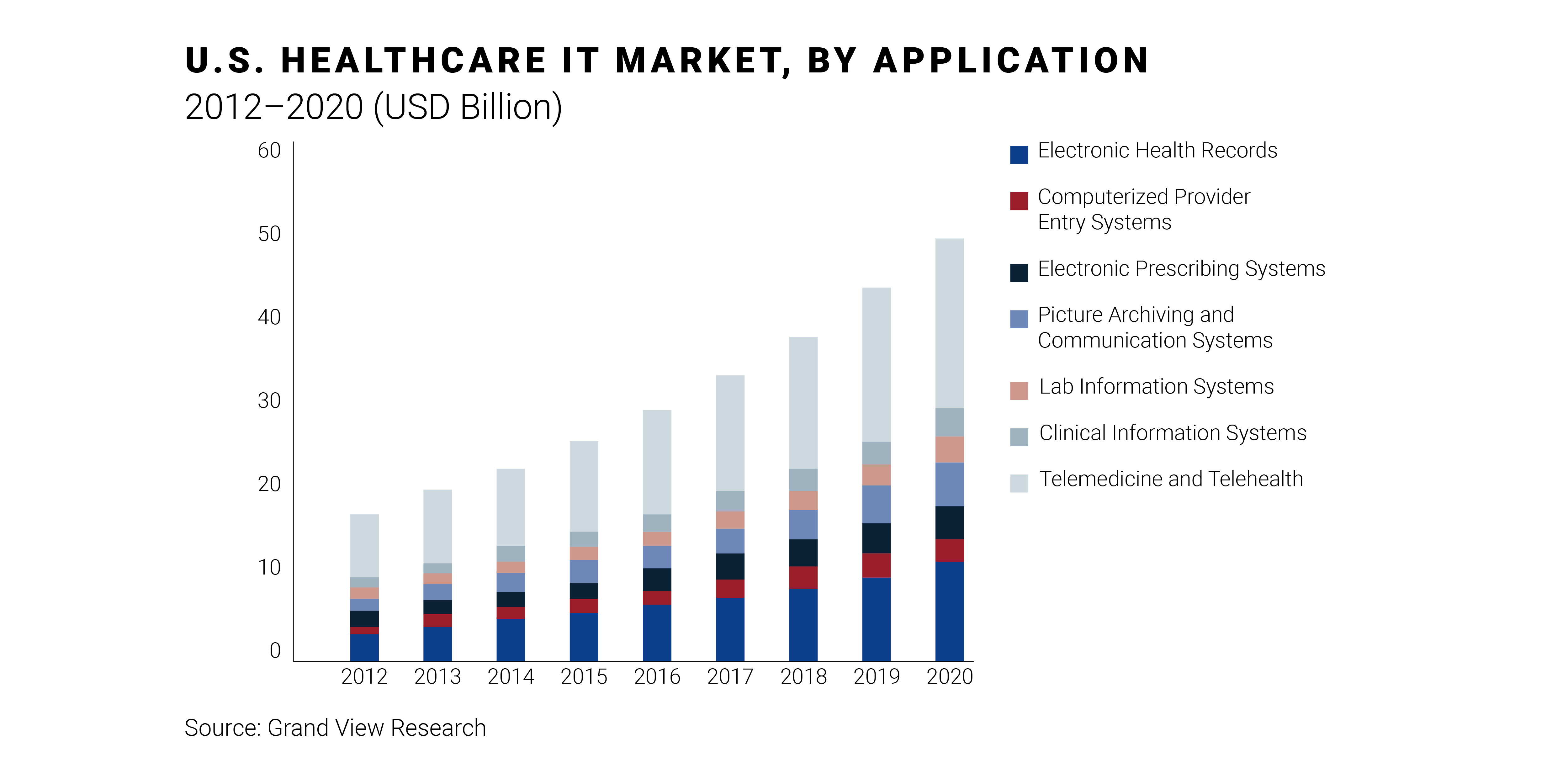

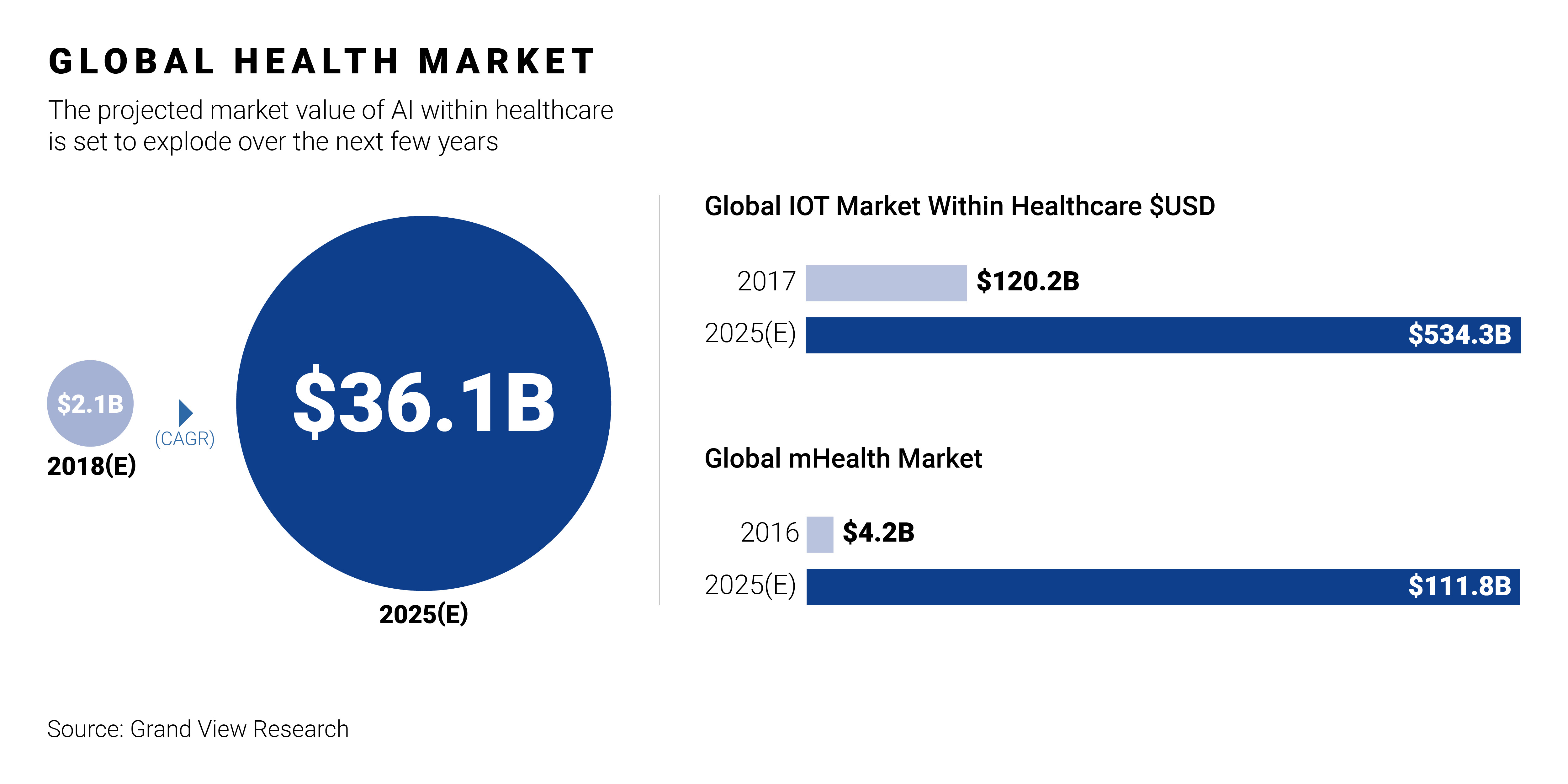

Harris Healthcare sells a range of software tools to help hospitals, doctors, and nurses deliver medical services to patients safely and effectively. Those tools are prime candidates for export because the global market for digital health products — ranging from electronic health records to wireless patient monitoring devices — is expected to explode from $86 billion in 2018 to $504 billion in 2025, according to Global Market Insights, a research and consulting firm.

With this outlook in mind, Harris Healthcare is focusing its international expansion efforts on a handful of its software tools for hospitals, including:

- QCPR-Novus Electronic Health Record, which creates and integrates paperless processes, such as for clinical documentation and electronic prescribing.

- Novus Portal, which can be integrated with any electronic medical record system and allows patients to view and download their health information, including medications, discharge instructions, and test results. Patients also can schedule and track their appointments and complete online forms.

- AcuityPlus: Nursing Resource Management, which determines appropriate staffing levels of nurses based on patients’ needs, including the severity and complexity of their medical issues.

- Harris Antimicrobial/Infection Control, which allows hospitals to collect, manage, and analyze data about infection cases and potential outbreaks as part of their antimicrobial and infection-control programs and optimize the selection of antibiotics.

- SynergyCheck Interface Monitor, which proactively monitors interfaces between software systems at an organization and sends alerts when problems occur.

- Uniphy Health Clinical Communications, a configurable, extensible communications and collaboration mobility platform which enables secure text, voice, and video communication on mobile devices between providers.

Our approach is to have a local partner who understands that market, has connections, and can get stronger and quicker leads into that market.

Harris Healthcare is already selling some of those products in the United Kingdom, Canada, Saudi Arabia, and Kuwait. In the United Kingdom, Lancashire Teaching Hospitals (LTH) NHS Foundation Trust is one of Harris Healthcare’s marquee customers. Lancashire Teaching Hospitals, which serves people in Northwest England, operates 960 hospital beds at Royal Preston Hospital and Chorley and South Ribble Hospital. The health care provider transitioned from paper to digital records by installing QCPR-Novus Electronic Health Record and is one of the first hospital systems in the U.K. to have integrated physiological monitoring devices with electronic patient records and deployed e-prescribing functionality.

Building off these successes internationally, Harris Healthcare is moving forward in new markets. But it isn’t renting office space or hiring employees overseas. Instead, it’s developing partnerships with local technology companies or software resellers in each international market.

The partners will then add Harris Healthcare’s digital solutions to the lineup of products they sell.

Affiliating with a local company solves one of the biggest hurdles to selling internationally — “Getting your foot in the door and getting known by the decision-makers in those markets,” as Ryan Brunswick, strategic partnership manager at Harris Healthcare, put it. “That is why our approach is to have a local partner who understands the local requirements, has connections, and can get stronger and quicker leads into that market,” he said.

But finding the right partner isn’t easy. “Not every company that is interested in you is going to be the right fit for you, and vice versa. You have to find the right strategic fit. That takes evaluating many different opportunities,” Brunswick said.

For help, Harris Healthcare turned to VEDP and its Virginia Leaders in Export Trade (VALET) international business acceleration program. Harris Healthcare — which joined the program in 2018 and will finish its two-year term in January 2020 — is one of 25 companies that participate in VALET each year. The companies develop sales plans and business-expansion strategies and enter new markets.

“Leveraging the services of the VALET program has enabled us to analyze multiple markets simultaneously to make the most informed decision about which markets to focus on. It supplements our ongoing efforts,” Trabucco said.

To evaluate the potential of various countries as export markets, Brunswick researches such factors as the amount of money each country spends on health care services and the degree to which local hospitals use digital processes — such as digital patient records and prescriptions — to care for patients.

In the U.K. and other technologically mature markets, electronic medical records are commonplace. Hospital executives in those countries might be more interested in Harris Healthcare’s tools to improve nursing resource management or infection control, or to manage interfaces connecting disparate software tools.

But those advanced software services would be considered a luxury in less mature markets, where hospitals would be more interested in replacing paper charts and prescriptions with an electronic health-records and medication-ordering system, Brunswick said.

Government laws and regulations also play a role in deciding which products to sell in a given market. Ireland and Scotland, for example, both have minimum staffing regulations that ensure hospitals deploy an adequate number of qualified nurses during each shift to take care of patients safely. These type of regulations is part of what Harris Healthcare looks into when deciding which markets to pursue, Brunswick said. The acuity-based staffing solution available in the Harris Healthcare portfolio aligns with these country regulations and ensures safe staffing.

Not every company that is interested in you is going to be the right fit for you, and vice versa. You have to find the right strategic fit. That takes evaluating many different opportunities.

But sometimes there is no better way to measure the potential of a market than to visit there in person. To that end, Brunswick has been on VEDP-sponsored trade missions this year to Mexico, Brazil, and Australia.

Brunswick says the most valuable aspect of the program is the ability to leverage in-country consultants to open doors during market visits. The program has also helped define Harris Healthcare’s international strategy and identify opportunities and insights on where to focus.

A typical country visit includes meetings with potential partners and resellers as well as local health systems or a hospital providing insights on the market and opportunities. Additionally, trade missions often align with industry conferences that are attended. Collectively, these meetings provide a comprehensive understanding of where the country is in their digital transformation and how Harris Healthcare solutions can advance their digital journey to the next level.