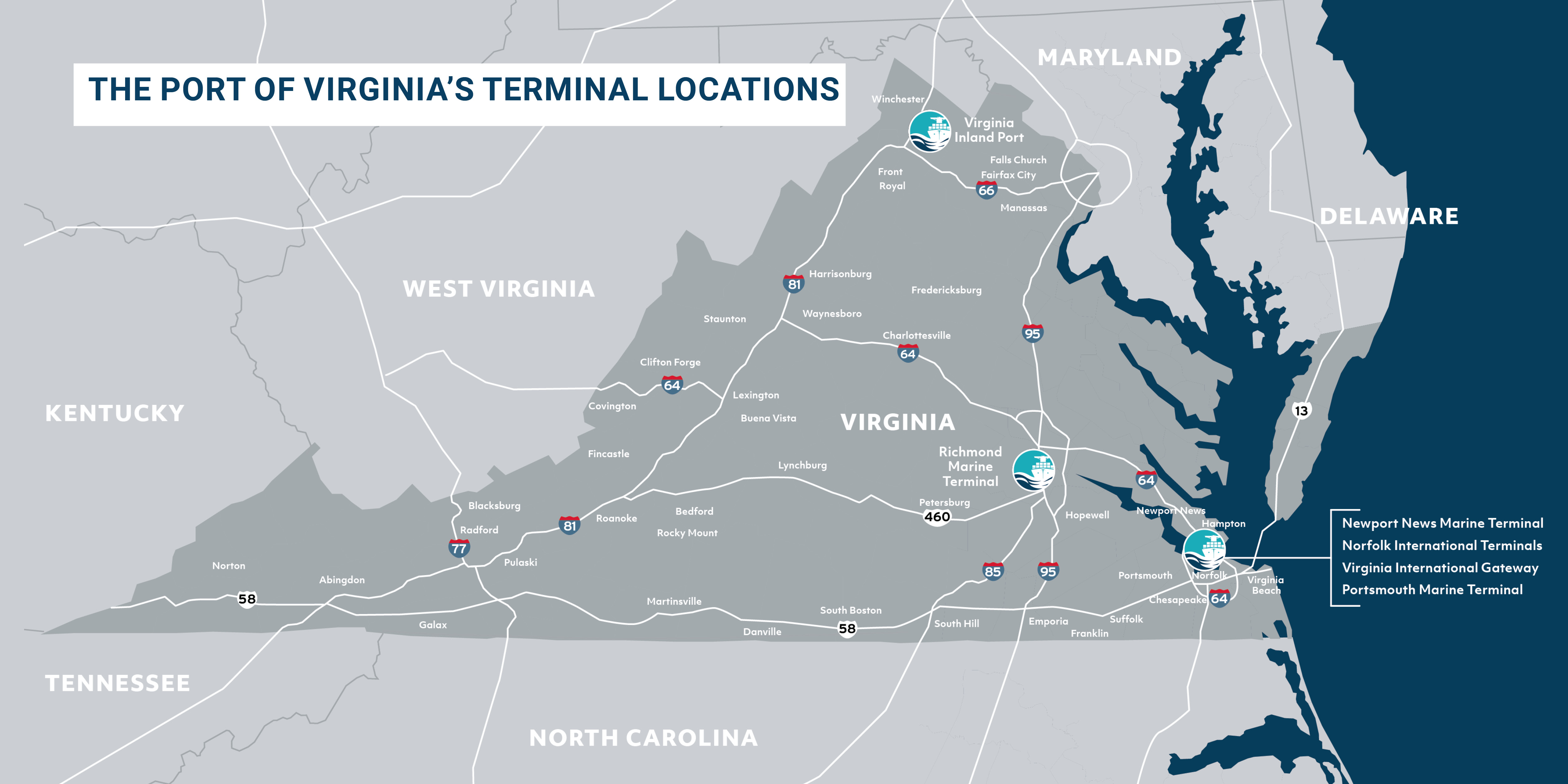

The other inland port, the Richmond Marine Terminal (RMT), is located along Interstate 95 and is linked to the port’s main container terminals in Norfolk Harbor by thrice weekly container-on-barge service. Its 2020 barge volumes were up nearly 9%, with overall cargo volumes up 20%. The terminal offers connections to CSX and Norfolk Southern rail on inducement via a local switch.

In 2015, the city of Richmond agreed to lease the terminal to the port for 40 years. The result has been expanding volumes and development of new warehouse operations near the terminal, with Amazon, Bissell, Lidl, and LL Flooring among the companies building new space nearby.

Building a 21st-Century Port

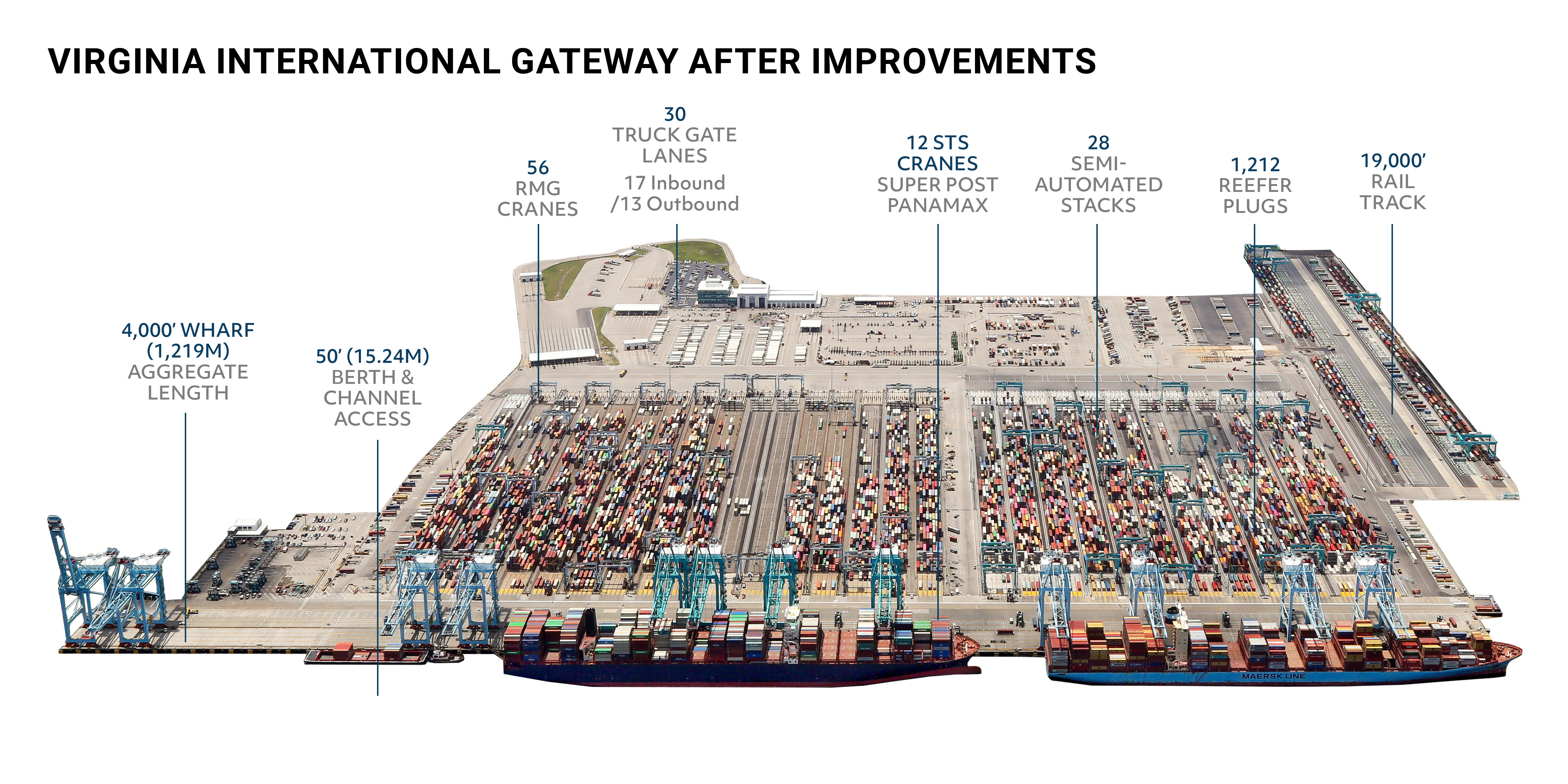

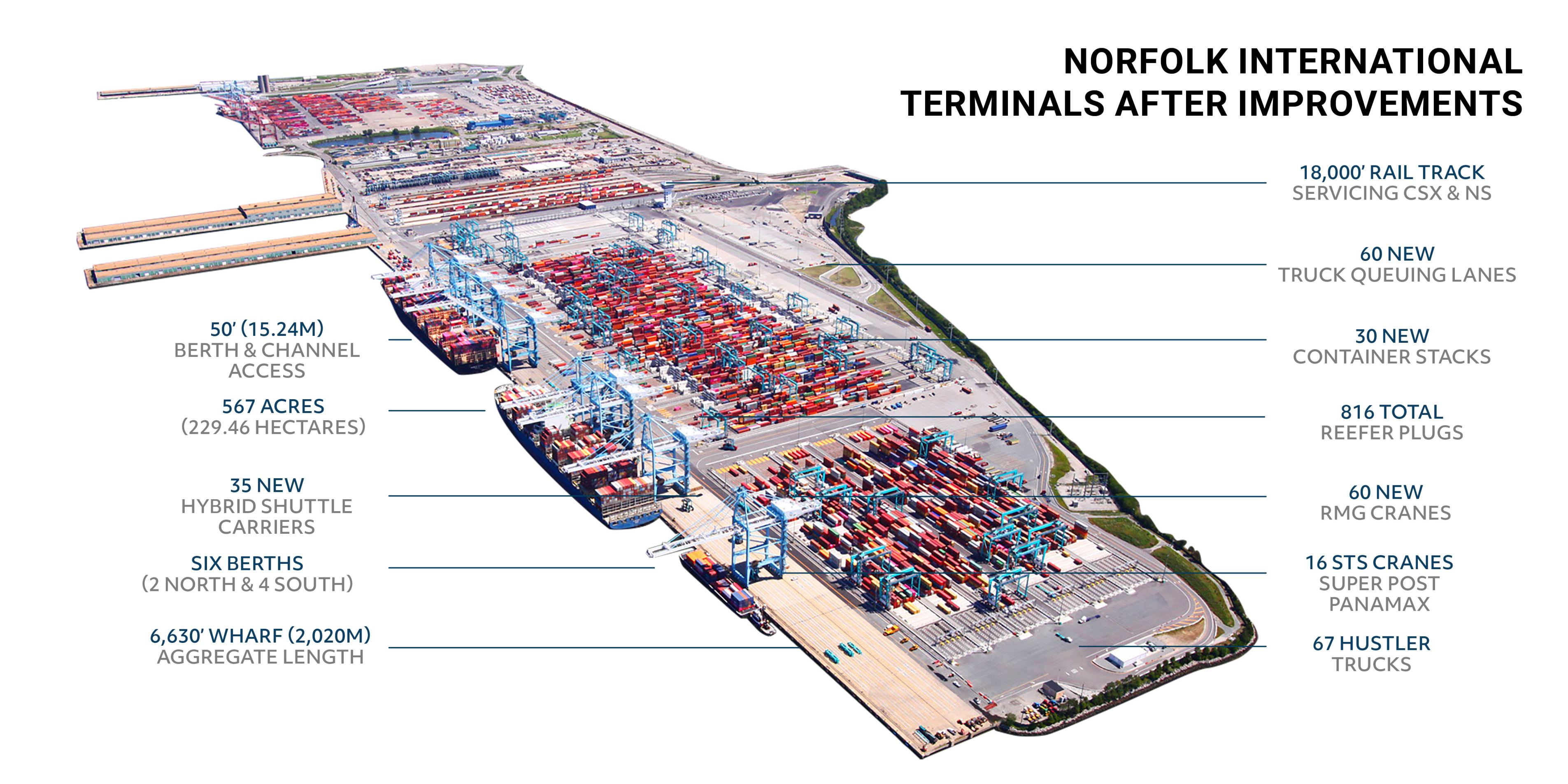

Former VPA CEO John Reinhart worked with the Virginia Maritime Association and state leaders to launch a modernization program aimed at improving operational efficiency. Construction began in 2016 on a $320 million investment at VIG to increase its capacity by 40%, with new ship-to-shore cranes, a doubling of the capacity in the container stack yard, expansion of the terminal’s rail capacity, a lengthened berth, additional lanes at the truck gate, and an update to the terminal’s operating system, with work finishing in 2019. NIT saw a separate $425 million upgrade that wrapped up in January 2021, with new ship-to-shore cranes, a doubling of the number of stacks, a new 26-lane semi-automated truck gate, and a new terminal operating system.

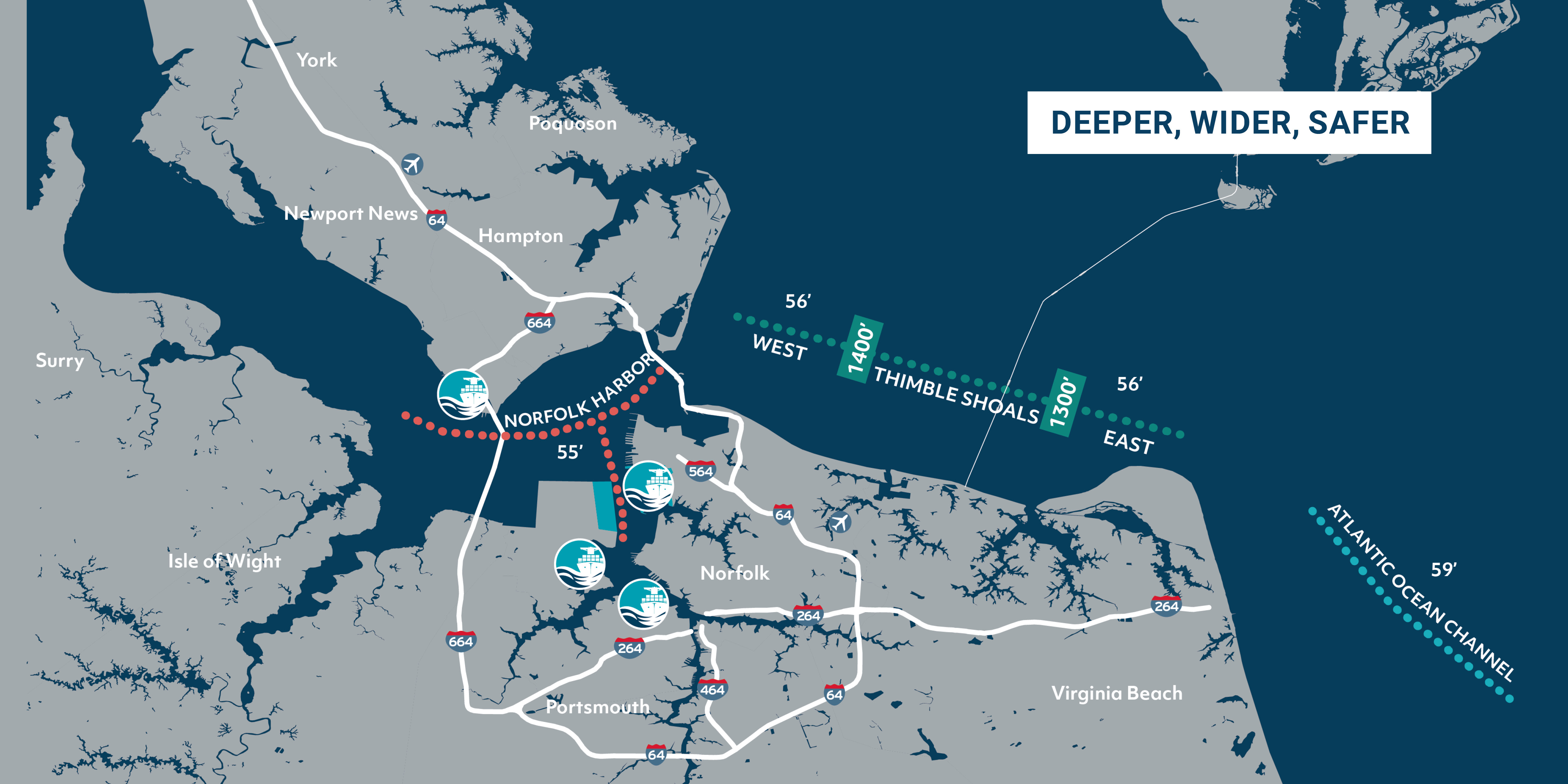

An additional $350 million is being spent to deepen the inner harbor to 55 feet and widen the channel to accommodate two-way ULCV traffic, with a goal completion date of 2024. The deeper channel will enable unobstructed access for the very largest ships with maximum loads and no height restrictions.