Yui: A very important part that affects people directly is trade, direct investment, and commerce. What my office does here in the United States, as with any embassy, is to offer our business community opportunities that they can have in the United States and vice versa, to offer U.S. companies to learn more about what they can invest in Taiwan. So it’s a two-way job. What my office is doing nowadays is coordinating closely with the U.S. administration and Congress the passage — hopefully very soon — of the avoidance of double taxation agreement between Taiwan and the United States. Once that agreement passes, it’ll be a great incentive both to U.S. and Taiwanese companies to invest.

El Koubi: You’ve mentioned that the United States and Taiwan enjoy a very strong economic relationship. Can you go in a little bit more depth there?

Yui: In global terms, we’re your eighth-largest trading partner, and the United States is our second-largest trading partner. Last year, our trading volume was around $120 billion. So it’s larger than the trade that the United States has with India, larger than what you have with Vietnam, the Netherlands, France, Italy, etc. Since 2020, between the United States and Taiwan, we’ve had this Economic Prosperity Partnership Dialogue. It’s between both sides to find ways to enhance this trading partnership. We also have the Technology Trade and Investment Collaboration to enhance our trade and investment in the tech industry.

Nowadays our partnership is, more and more, focused on technology, on 5G semiconductors, on electric mobility. Many of our companies, like TSMC, GlobalWafers, etc., come to the United States to invest, and vice versa. Many of your U.S. companies have gone to Taiwan to do similar things.

Taiwan is Virginia’s ninth-largest export market and 10th-largest import source market. The two-way trade is almost $2 billion between Virginia and Taiwan. We have many, many Taiwanese companies who are already investing in Virginia — mainly tech companies.

El Koubi: One of the big things that VEDP did last year, with support from the governor and others, was to establish an office in Taipei, in the capital of Taiwan. We have Sarah Liu there, our director of strategic projects and lead generation for Taiwan, who represents Virginia full-time now. We’re very proud of that and we look forward to deepening the relationship that you just described.

Yui: That is very important. We had the pleasure of having Gov. Glenn Youngkin visit Taiwan with a delegation in April of last year, and he announced the opening of that office, which opened formally in September. That’s an important step in promoting our foreign direct investment relations.

El Koubi: Thank you for the terrific partnership in getting that started. It’s been a big year for Taiwan in other ways. There was a recent presidential election. Can you comment on what you see as the major consequences of the recent Taiwanese elections on global trade and on the economy of economic relationships?

Yui: On Jan. 13, we held our elections to elect our president, vice president, and our legislative body. The elections were praised generally by the United States, by the European Union, etc. Having had these series of free elections throughout the years brings stability and steadiness to our economy, and it shows the guarantee to the investors that Taiwan is a country that can be trusted, dependable, and we play by the rules. Certainly, there are many challenges. We are challenged continuously by mainland China. But assessment companies and risk companies continually keep putting Taiwan as the best-grade place to be.

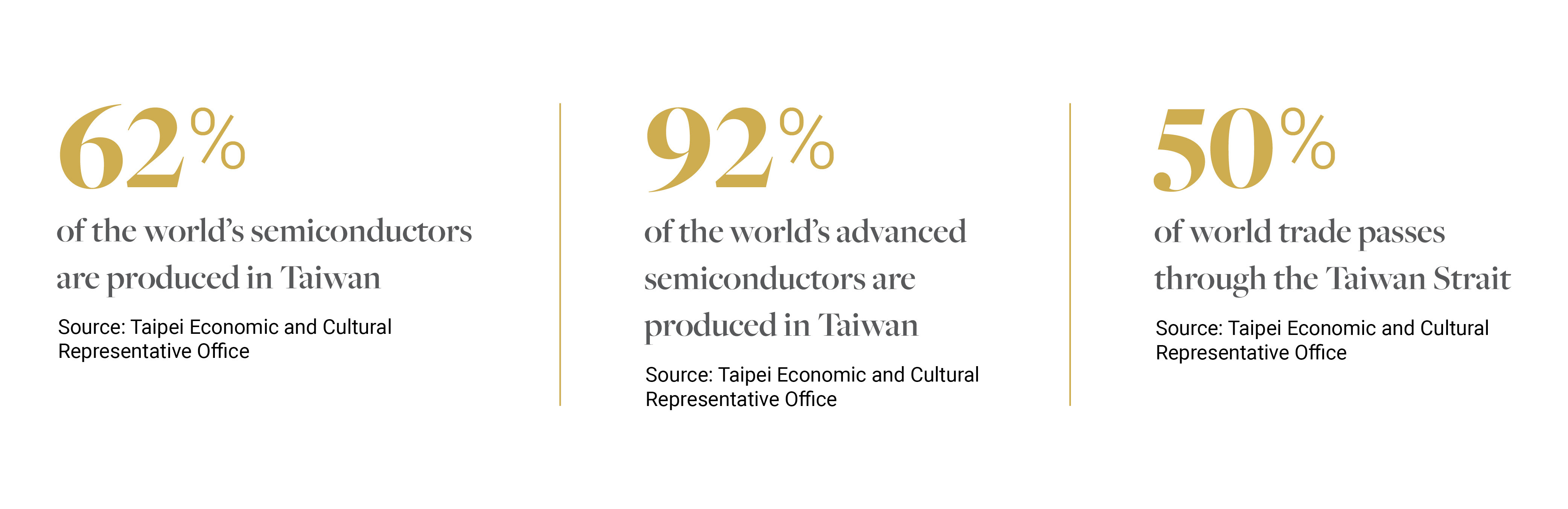

There is a reason why, in Taiwan, our semiconductor companies produce 62% of our world’s semiconductors and 92% of the advanced semiconductors. Taiwan is a high-tech hub, and more than 50% of world trade goes through the Taiwan Strait. Taiwan is a relevant place to be. By having free elections and by choosing our leaders every four years, we have a smooth and steady transition. It shows that Taiwan is a stable, trustful place, and that foreign investors can depend on and come to Taiwan to invest and do business.

El Koubi: What is the view of the U.S. market from the Taiwanese perspective? What draws Taiwanese companies to make major business investments in the United States?

Yui: We are important trading partners and this collaboration between Taiwanese and American companies is long-standing. At Tesla, 75% percent of the supply chain comes from Taiwan. It’s one example of the close collaboration between U.S. companies and Taiwanese companies, one of many. TSMC is highly involved with U.S. companies as well.

We speak of the G20. But if there was a G21, Taiwan would be in it. We’re the 21st-largest economy in the world. Our economy is larger than 22 of the 27 countries in the European Union. One of the most important destinations for our outbound investments is the United States. You have a set of clear rules, you have a good labor force. Technologically, we’re at par, and complementary in terms of our trading relationships. We are like-minded countries. We value the same things — freedom, democracy, these things that we hold dear — and we learn a lot from the United States.