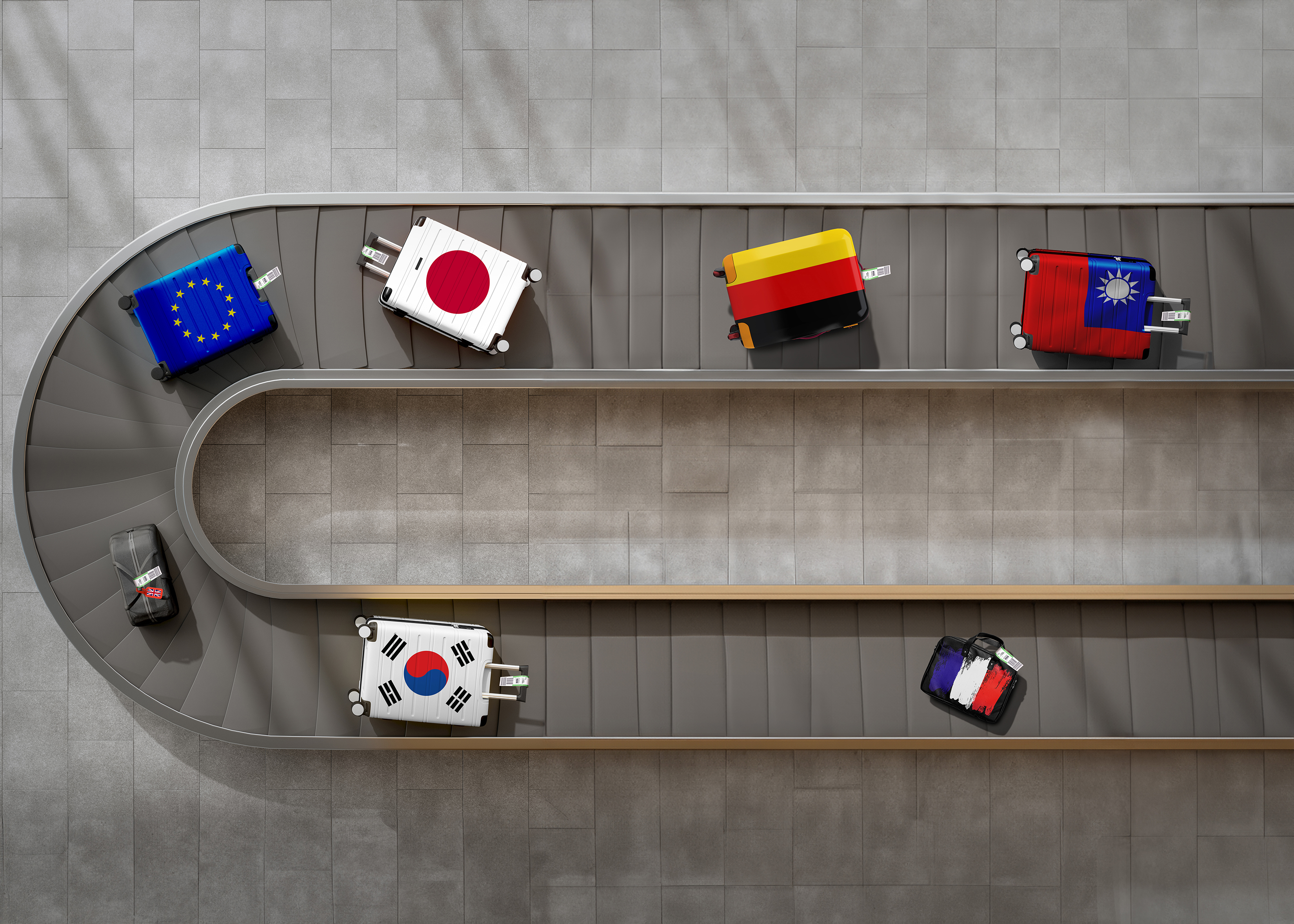

Global Capital, Local Impact

How foreign direct investment helps the U.S. economy and creates jobs

Foreign direct investment (FDI) is a sometimes overlooked, but vital, cornerstone of the U.S. economy. Investments from overseas create high-quality, skilled jobs that pay higher-than-average wages. In 2022, foreign direct investment to acquire, establish, or expand U.S. businesses totaled more than $177 billion, according to the U.S. Bureau of Economic Analysis. Manufacturing took in nearly a third of that amount, or $55.2 billion. More than 1,000 foreign-owned companies operate in Virginia, employing more than 200,000 people.

It speaks to the importance of FDI to the Virginia economy and companies alike that foreign companies that invest in Virginia often come back for future expansions. Belgian warehousing and distribution company Katoen Natie has expanded its Norfolk facility twice since opening it in 2011. Weidmüller Group, a German industrial connectivity solutions provider, has operated in the Richmond area since the 1970s and announced an expansion in 2023. Swiss food and beverage giant Nestlé S.A. relocated its U.S. headquarters from California to Arlington County in 2017. Nestlé has since made two substantial subsidiary investments in Virginia, with Gerber Products Company moving its headquarters to Arlington County in 2018, and Nestlé Purina Pet Care expanding its manufacturing plant in King William County in 2021.

Ripple Effects

Multinational enterprises that plant roots in Virginia help companies expand, create more employment, foster innovation, and boost local economies. Nationwide, international companies employ 7.9 million U.S. workers who earn an average of $86,859 annually, 7% higher than the economy-wide average. In Northern Virginia, foreign companies paid an estimated $6.8 billion in wages in 2022, averaging an estimated $133,058 per job, 24.3% higher than average.

Higher salaries are indicative of the technology and valuable skills that global companies prize. Multinationals setting up shop in the United States tend to be highly efficient and deal in advanced technology.

“The workers that they hire in the U.S. tend to be more skilled than average because their advanced production techniques require workers with similarly advanced skills and education,” said Sonal Pandya, Ph.D., an associate professor of politics at the University of Virginia who researches international political economy and the influence of politics on global production.

The U.S. is a top destination for global companies with large amounts of intellectual property. Foreign investment finances 13% of all research and development performed by U.S. companies, or $78 billion a year.

In addition to foreign investment’s direct benefits, the local economy feels indirect ripple effects. A company using foreign capital to expand, or a foreign company opening an office or manufacturing or research facility, creates opportunities for suppliers and other businesses that serve the community. More people move to the area, boosting the need for houses, restaurants, entertainment, and other amenities. “There’s a multiplier effect,” said Pandya.

Foreign investment also helps diversify a local economy. Foreign manufacturing companies often produce goods that are sold elsewhere in the country or even abroad, whereas local companies might be selling locally or regionally. Adding export-oriented producers helps diversify the economy, which helps when the state experiences any negative economic shocks.

“If a majority of firms produce goods for sale locally, then you haven’t really diversified your risk,” Pandya said. “So, it offers a source of resilience.”

The Virginia Advantage

Virginia’s appeal to foreign companies starts with an advantageous mid-Atlantic location. The Commonwealth also benefits from its proximity to policymakers in Washington, D.C., its ports and other infrastructure, a relatively affordable cost of living, a strong network of universities, and a well-established reputation for being business-friendly. As Weidmüller USA President Bernd Schröder said when announcing the company’s most recent expansion, “We are thrilled to have the opportunity to expand in a state known for a talented workforce, strong logistical benefits with access to Virginia ports, and strategically located to best service our partners.”

These qualities often put Virginia above some West Coast states, even for companies in Asia that are farther away geographically, he said.

In Northern Virginia, the Commonwealth’s most populated region and main commerce hub, an established concentration of tech, telecom, and biotech companies makes it an attractive investment destination for companies in those industries. “There’s a lot of historical momentum going back to the early days of technology, when companies like AOL and Nextel opened their corporate headquarters in Northern Virginia,” said Andrew Sherman, a partner at law firm Brown Rudnick in Washington, D.C., who specializes in the legal and strategic aspects of business growth.

Sherman added that Virginia’s longstanding pro-business reputation and quality-of-life factors can push the Commonwealth ahead of other states. For European companies, the relatively short time difference of 5–6 hours is advantageous.

Major foreign employers in Northern Virginia include air freight providers that make heavy use of Washington Dulles International Airport, including Dutch aerospace company Airbus and German cargo airline Lufthansa Cargo. Other key FDI sectors in the region include automotive (Audi USA and Volkswagen Group of America, both subsidiaries of German companies), food and beverage (headquarters operations for the aforementioned Nestlé USA and Lidl US, the American arm of the German supermarket chain), and government contracting (Irish consulting firm Accenture, British defense firm BAE Systems, and Canadian IT and consulting firm CGI Inc.).

Jonathan Lazarow, a partner at Virginia-based law firm Ambrose, Mills, & Lazarow, said he works with foreign tech companies that could choose to be anywhere, including Silicon Valley in California, but choose Virginia because “in terms of innovation, it’s just as innovative.”

Foreign companies that come to the U.S. often need to find people with specialized knowledge in certain technologies. Virginia has a good reputation for helping companies find talent relevant to the local market, and the Virginia Talent Accelerator Program — honored by Business Facilities as the top customized workforce training program in the country — can help companies accelerate new facility startups through direct delivery of recruitment and training services.

The legal framework and economic incentives can help but, ultimately, it’s the informal network that is perhaps the most important factor in protecting or ensuring return on investment, Lazarow said. “Reputation matters way more in this environment than anything in a legal system or any kind of economic incentive. From a business standpoint, the most important thing is confidence that an investment will yield profit, and Virginia is getting that right.”