Factors in Corporate Headquarters Location Decisions

A Conversation With Greg Burkart, Jeannette Goldsmith, and Chris Schastok

In the competitive realm of corporate headquarters location decisions, the COVID-19 pandemic upended the way companies operate and could have major ramifications on office space moving forward. VEDP President and CEO Stephen Moret spoke with three leading site consultants on the factors that affect corporate headquarters location decisions, how companies will operate differently coming out of the pandemic, and the advantages Virginia has in attracting corporate headquarters investment.

Stephen Moret: It’s a very interesting time for corporate real estate decisions in the country as companies navigate a major pandemic. What are the main criteria considered in location searches for corporate headquarters?

Greg Burkart: The main criteria that we see for headquarters are really two. The first one is labor force, particularly labor force that has experience in the given industry sectors.

Second is accessibility. We gauge the accessibility to the company’s operations across the United States, but also across the globe. And then the proximity to customers and how quickly corporate executives can get out and be with customers, or have customers visit them.

Jeannette Goldsmith: There’s a culture element, too. A location has to make sense for a company from a culture perspective. It’s, “Do we fit in with this community? What does this community project about our company to the outside world?”

I’ll use as an example Nissan’s headquarters relocation to Tennessee. Nissan was the first Japanese company to have an automotive plant in the southeastern United States with the plant in Smyrna. Relocating to Tennessee fit the image that they wanted to project to their customers and to the world.

Chris Schastok: Not only culture, not only impact on brand position, but a big component around talent. Often, when you look at relocating a corporate headquarters, it’s not a five-year decision — it’s a 50-year decision. It presents the opportunity to leapfrog competition and, if it’s done correctly, become the employer of choice, focusing not only on retention, but also attraction of talent.

Moret: As you think about headquarters location decisions, specifically, what do you see as the major trends that will affect company operations over the next few years? What have you seen shift over the last several years? Coming out of the COVID-19 pandemic, what might shift about how companies think about headquarters location decisions?

Goldsmith: As companies begin to look for new headquarters locations, oftentimes that means building a new building or a new facility for their headquarters. When they start to do that design and construction work, a couple of big trends emerge.

One is ride-sharing and autonomous vehicles. Companies are not building as much parking as maybe they would have 10 or 15 years ago because they know this trend is coming and people aren’t going to own cars and park when they come to work. The other trend I’m seeing is toward more flexible space that can be used for multiple purposes.

When you look at relocating a corporate headquarters, it's not a five-year decision — it's a 50-year decision. It presents the opportunity to leapfrog competition and, if it's done correctly, become the employer of choice, focusing not only on retention, but also attraction of talent.

Schastok: The demographics of the country are changing and the workforce is changing, with components like health and wellness at the forefront. As the world becomes flatter from an accessibility standpoint, how does the current location versus a new location, or multiple new locations, play into what they’re really trying to offer the folks that come work there every single day?

I think coming out of 2020, similar to how we came out of 2009, there will be a return to cost consideration at the corporate decision-making level. But we’re hearing a lot of our clients also circle that cost-of-living bucket and say, “The way we’re looking at costs is the impact to our employees, the ability to own a home or rent a home, or commute and live, work, and play in a community.” I think we’ll revisit some corporate decision-making that brings the employee back to front and center.

To put a bow around it, it’s a big, long look at how you can keep the folks who are coming to work every day happy, healthy, and content with their jobs.

Burkart: If you’re in an urban core and your headquarters team is in an elevator and commuting through a congested lobby, you have some real practical considerations about having your colleagues actually be able to get to the office safely. So we’re seeing a lot of discussion around risk minimization, particularly as it relates to urban cores.

It’s bringing more rural and suburban locations into play, whereas, I think over the last decade, we’ve seen this shift to the urban core. We’re now starting to have some discussions about reversing that, or having a smaller team in the urban setting and pushing the much larger team out to the suburbs or to more rural locations.

Moret: We’ve seen a sea change in the extent of remote work in the country in the wake of social distancing requirements associated with a pandemic, especially early on. How do you think that will affect the future of corporate headquarters locations? What kinds of locations do you think would or could benefit from a trend toward more hybrid or fully remote jobs?

Schastok: The pandemic, while it feels like it’s been a long time, is a pretty short window to look at, and it has greatly impacted the corporate office landscape. You look at employee surveys coming out regarding remote work, and a large swath of the working population report at least currently that they enjoy the increased flexibility, not having to commute to major urban cores. It costs money to eat, it costs money to park, it costs money to take the train.

You might spend 20 minutes or an hour commuting to and from the office. The one thing we all have is 24 hours in a day, so one of the most valuable things was getting time back and being more efficient with it. And I think there is a quotient of the C-suite that looks at the ability to get more time and more efficiency out of people. That’s something that’s been really favorable.

From a team and a collaboration standpoint, while we’ve all done a really great job leveraging the tools we have to work remotely, it simply will never replace face-to-face human interaction. So, what does that really mean? I think what you’re seeing right now is a lot of kicking the can down the road on office-related projects — a lot of short-term renewals.

I think it’ll be a couple more years until we really get this thing evened out. But my belief is that remote work is not here to stay. I think flexibility may be here to stay, but I do believe that we will all be back in our respective offices working again together.

A location has to make sense for a company from a culture perspective. It's, 'Do we fit in with this community? What does this community project about our company to the outside world?'

Burkart: The headquarters projects that we’re working on right now, some were before the pandemic and a couple have cropped up since the pandemic. The projects are getting smaller. The executive teams are trying to determine what core leadership is required to be together on a consistent basis.

You’ll have much smaller dedicated offices and these isolated open areas that would allow for team collaboration, but also easy changeover from one meeting to another, to allow appropriate hygiene and sanitation to take place.

The discussions we’re having so far from executives have been about much smaller core HQs, with the extended enterprise for back-office operations. The debate we’re hearing right now from a lot of our clients is, do they include R&D? That’s the intellectual heart of the company. It depends a lot on corporate strategy. But for those companies that pride themselves on innovation, they certainly consider their R&D colleagues to be a core part of the leadership team.

Goldsmith: We are going to go back to work in an office. I think there have been productivity losses, and the lack of social interaction really takes a toll.

How we go back to an office is going to look different. Some companies during the pandemic have adopted a rotating schedule so that only a certain number of people are in the building on any given day. Maybe that stays. The built space is going to change dramatically to allow for the flexibility that’s needed to accommodate personal offices as well as larger collaborative space in a much smaller footprint.

Moret: Are small to mid-size metros on your clients’ radar when they’re initially thinking about where a project might fit, particularly a corporate headquarters project? What can smaller metros do to attract more corporate headquarters projects?

Burkart: For the smaller metro areas to be competitive, it’s all about accessibility. What connectivity does that community have? What sort of information and communications infrastructure is there? Do they have 5G? Do they have fiber extended throughout the community? Connectivity is really, really important for smaller communities.

If you look at the growth over the last 12 to 18 months, I’m amazed at the number of smaller metro areas that are essentially vacation markets. Take a look at in Traverse City in northwest Michigan. I think it’s approaching almost 20% growth with permanent residents moving in. Same thing down in Texas and some of the communities surrounding Austin, and in New Orleans and some of the surrounding parishes.

That might be a result of what we were just discussing about the remote workforce. They’ve moved out of the urban to suburban locations and reached for more space. That’s where I’m seeing a lot of growth, particularly here in the Midwest.

Schastok: When you’re talking about an HQ relocation, no project is identical to another. Think about the Amazon project you guys have in Northern Virginia. That project fits into your Virginia story very well, versus some other places in the country that just couldn’t accommodate that type of growth.

If you take Chicago, where I live, what you see is a glut of companies that have spent the last decade moving their headquarters to downtown Chicago. And that is all about talent.

I think a smaller community can compete like a big community for a headquarters project. It just has to be the right type of project. You’re not going to have a company move 5,000 jobs into a market where you’d automatically be the big fish in a medium-sized pond, and then have your competition for talent and ability to attract slightly hindered based just on the size of the community.

There are a lot of high-value markets out there outside of the big cities that are very, very promising places for corporations to relocate to. At the end of the day, it’s going to come down to the scope and criteria of what the company wants to do.

For the smaller metro areas to be competitive, it's all about accessibility. What connectivity does that community have? What sort of information and communications infrastructure is there?

Goldsmith: If a company is of a size that might consider a smaller community or a rural area, they’re going to look for areas that fit their company culture. So, what communities need to be focusing on, if that’s their goal, is placemaking. What can they do to make their community stand out? Rural communities need to make sure they have the amenities that are going to be important to a headquarters project.

Is that more green space? Biking trails? A vibrant downtown? Certain types of housing? Taking care of those traditional community development activities that are going to make their community stand out to a company that’s looking to relocate their corporate headquarters.

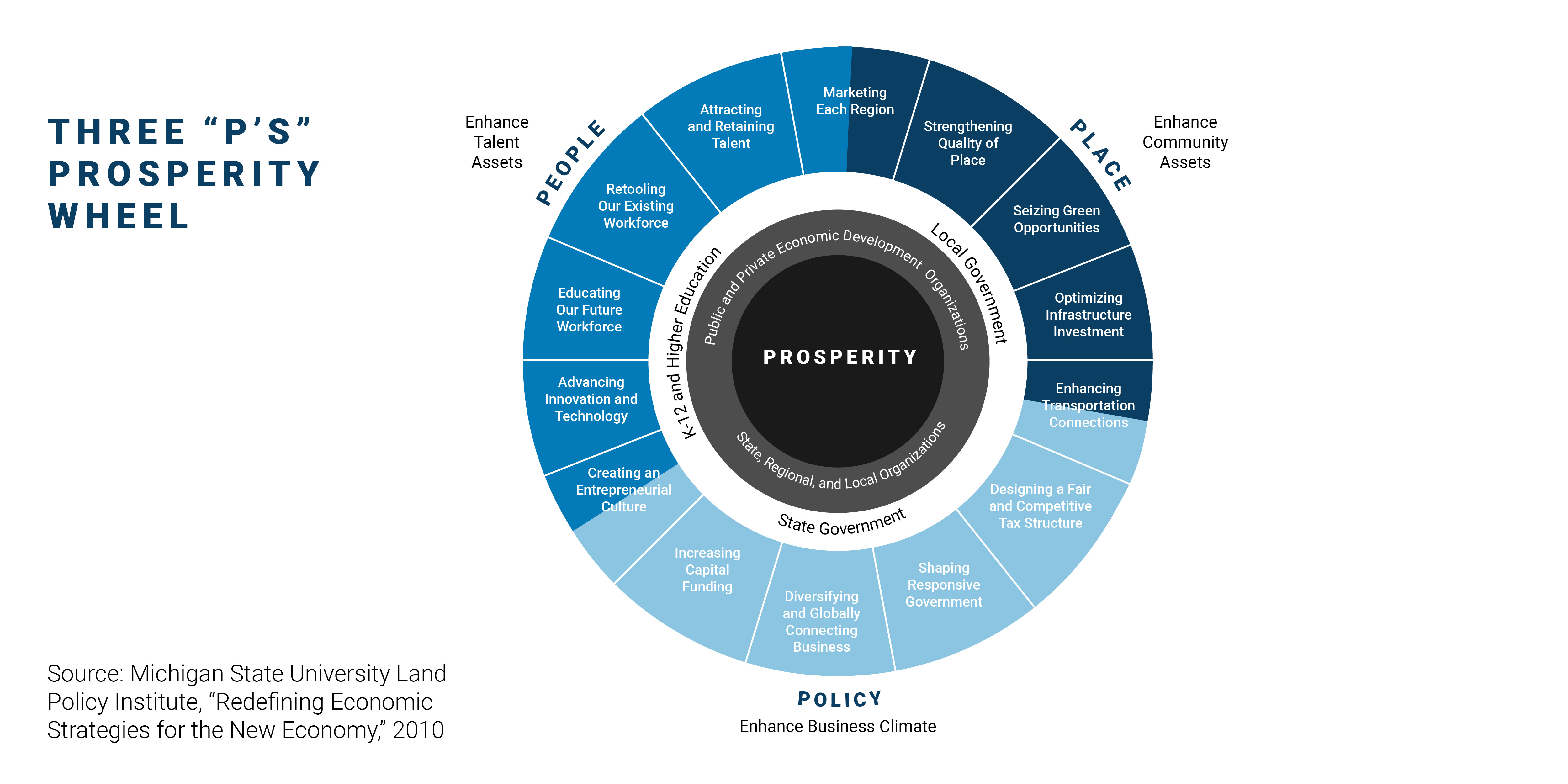

Burkart: There’s a study from Michigan State University from 2009 that’s probably the seminal study in placemaking. If a community is looking to be competitive, whether it’s a smaller community or a larger community, public amenities are tremendously important. There’s actually a rate of return that’s projected with a formula showing how certain investments in these public amenities will yield X number of dollars of increase in per capita income, and it’s been pretty accurate.

Moret: Is there anything else we didn’t hit on in terms of things that states and regions can do to better position themselves as attractive locations for corporate headquarters?

Goldsmith: We’re active with a corporate headquarters project right now, and one of the things that has frustrated me is an inability to understand the talent pipeline. Specifically, if my client is looking for a specific skillset, we want to know how many people in XYZ major graduate from the major universities and colleges in a certain region. How many of those people stay in the region and have jobs? How many of those people leave the region? Those data points help us understand what that talent pipeline is going to look like. A lot of places haven’t really mastered that yet, for a variety of reasons: It’s difficult to work with their local universities or a nonwillingness to do it. That piece of data is very important, but very hard to get.

Schastok: Collaboration with higher education is really key for these types of projects. Some states and sophisticated regional groups have done a really good job of paving the way to help companies put together a structured partnership around talent.

I think air transport will continue to be something that folks really depend on. There are some great stories out there about cities that have been able to get one of the larger air carriers to increase their gate capacity in the airport. That’s viewed very favorably, especially when you get outside of the top five airports that we can all rattle off. Companies need to figure out, “How are we still going to be able to get around the country and the globe if we pick up and move from our existing location?”

Moret: As you think about the Commonwealth of Virginia, what are the qualities that really help Virginia stand out as a location for corporate headquarters?

Burkart: The first thing that comes to mind with Virginia for headquarters projects is just the number of bachelor’s and post-graduate degrees the population has. The educational attainment is the highest in the country.

For headquarters, it’s also the location quotient for management executives, and the professional and scientific and engineering communities. You’re averaging almost a 2% growth rate over a five-year period for those occupations. Then you balance that with wages, and the average annual wage across the Commonwealth for managerial jobs is about $125,000 a year, which is lower than the national average of about $128,000 a year.

When you consider the concentration, the education attainment, versus the cost for what you’re getting, I think Virginia is a very, very competitive location for a headquarters.

Goldsmith: The No. 1 asset is the talent and the talent pipeline. In addition to the existing talent base you have, your universities and colleges are turning out excellent individuals in a multiple array of occupations. That’s definitely part of your talent advantage.

In addition, part of Virginia’s competitiveness in this area is your connectivity. If you include Baltimore, which I know is not in the Commonwealth, it gives you access to three airports that get you almost anywhere in the world. You offer corporate headquarters for whom air travel is important a lot of connectivity.

Schastok: It’s about pipeline development. You’ve got three of the country’s top universities in Virginia. You have growing markets that are very, very attractive. It’s a growing state. When you put all this together, Virginia clearly puts itself in the position to be at the table for a lot of these big discussions.

Moret: Did the Amazon HQ2 win do anything to change perceptions of Virginia as a location for corporate headquarters projects?

Goldsmith: One of the things that I think was done well was to brand that location as Northern Virginia, as opposed to Washington D.C. That allowed you to bill it as a Virginia win and distinguish that from D.C. as the major metropolitan area.

Moret: One thing a lot of folks don’t realize is that Northern Virginia is by far the largest source of headquarters, particularly for tech talent, in that region. The whole region is quite strong, but Northern Virginia is the biggest part of it.

Goldsmith: Amazon helped you tell that story broadly and loudly. That’s a concept which I think was really underscored with the Amazon decision.

Schastok: When it was all revealed, there were many for months who had said that the, quote, “greater D.C. Metro” would be in the mix. The fact that the project landed in Arlington gives you a new stack of chips to go out and say, “We were able to locate this. We’ve been able to support it.”

Burkart: I think the Amazon decision confirmed what we’ve been saying today about the Commonwealth, and certainly about Northern Virginia.

Going all the way out to Charlottesville, and down to Richmond, you certainly have communities with the capabilities to retain and attract that workforce. You’re in an enviable position with the universities in the Commonwealth, in the D.C. area, to attract those graduates to stay in the area. I think it’s reaffirming everything the Commonwealth has been doing over the last decade.

For the full interview, visit www.vedp.org/Podcasts