How Virginia Became the Data Center Capital of the World

Virginia is home to the largest assemblage of data centers in the world, with Northern Virginia alone accounting for more than 100 (out of 504 known hyperscale data centers worldwide) that total more than 13.5 million square feet of data center space. Synergy Research Group estimates that 25% of U.S. hyperscale data centers are located in Virginia.

In Northern Virginia, network connectivity traces its roots to the U.S. government’s experiments in wide-area fiber optic networking in the 1960s. Today, an intersection of mission-critical fiber backbones connects Virginia to all major markets in the U.S., along with the highest density of dark fiber in the world. In fact, 70% of internet IP traffic is either created or passes through Loudoun County’s “Data Center Alley,” making Ashburn the epicenter for global interconnection.

However, there’s more to the story. Virginia’s abundant, affordable electric power and growing sustainable energy generation, its business-friendly environment (including state and local incentives for the data center industry), stable climate with minimal natural disaster exposure, and educational initiatives training a tech-savvy workforce all support the continued growth of data centers across the state.

The importance of the coordination between electric utilities, local government, and state agencies to attract new business and support existing data center expansions can’t be overstated. In Loudoun County, the approval process for data centers has been streamlined through a fast-track program, while Dominion Energy’s ability to plan ahead and keep up with unprecedented development now supports 1,027 megawatts (MW) according to the CBRE 1H2019 North American Data Center report.

Where It All Began

In 1992, a consortium of private companies founded Metropolitan Area Exchange, East (MAE-East). A year later, the National Science Foundation awarded MFS/MAE-East a grant, establishing it as one of four original Network Access Points, along with Chicago, San Francisco, and Pennsauken, N.J.

Rich Miller, founder and editor of Data Center Frontier, said data center momentum began to accelerate in Northern Virginia in the late 1990s, when America Online located its headquarters in Dulles and Equinix built its first data center nearby. “The Equinix campus quickly became the web’s busiest meeting place, creating a powerful network effect in which each new connection adds to the value of its digital ecosystem,” he said.

After the dot-com bust that began in 2000, internet purpose-built data centers didn’t come back until 2007 with the development of the DuPont Fabros Technology (DFT) VA4 data center, the result of a collaborative effort to proactively attract data centers to Ashburn.

Hossein Fateh, CEO and co-founder of DFT, provided the original hyperscalers (e.g. Yahoo!, Microsoft, and Facebook) a revolutionary infrastructure design: point-of-delivery architecture, a repeatable design pattern that maximizes scalability.

In 2007, Digital Realty Trust made a significant entry into the Ashburn market, acquiring Loudoun Exchange’s first three buildings. In June 2017, Digital Realty announced a merger with DFT, creating the largest single portfolio of data centers in Northern Virginia.

A Major Loss and a Big Win

Despite those successes, it was a project Virginia didn’t land that helped launch the Commonwealth to its current heights. In 2009, Apple decided to build a $1 billion data center in Maiden, N.C., instead of Virginia. The next year, Virginia significantly expanded the state’s data center sales and use tax exemption on computer equipment.

In Virginia, data center companies receive exemptions for sales and use taxes on equipment and software if they invest more than $150 million in capital investment and create 50 new jobs paying at least one and one-half times the average prevailing wage, with those requirements lowered for projects located in unemployment-distressed communities or in Enterprise Zones. The Virginia General Assembly recently extended those economic incentives through 2035.

In addition, many localities offer reduced personal property taxes on data center computers and related equipment. In 2018, the General Assembly enacted a bill that created a specific classification for data centers for valuation purposes, assessed at the local level.

Tracking Record Growth

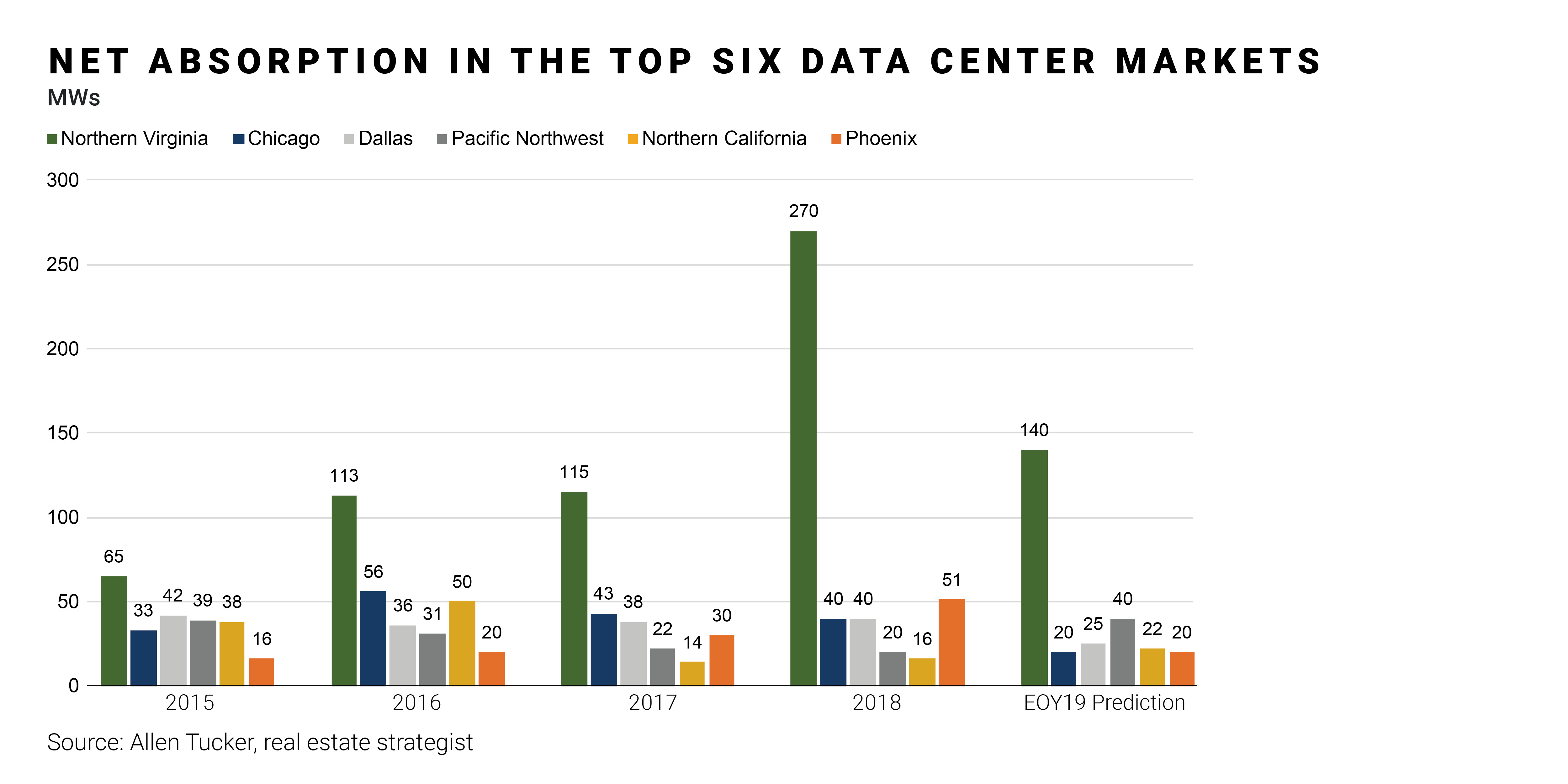

Data center strategist Allen Tucker has tracked data center activity in Virginia for more than 20 years. He recently compiled data on net absorption for co-location data centers located in the top six U.S. markets from 2015 to 2018. Northern Virginia data center leasing accounted for 62% of the megawatts absorbed in the top six U.S. markets during 2018, a significant increase from 44% of total bookings in 2017.