Illustration of Pen Place Public Plaza, National Landing

Additionally, the region’s affordable housing options would be ramped up by working with Fannie Mae and Freddie Mac to deliver a new regional initiative, increasing options via federally allocated Low Income Housing Credits, and having Arlington County and the City of Alexandria fund affordable housing from revenues generated by Amazon’s presence in the community, among other steps.

“There are a lot of cities where they have neighborhoods close to the urban core, but it’s not that common to have all these factors coincide with availability of space,” Kelly said.

Sure, National Landing overlooked the Capitol and hugged the Potomac River. But there remained abundant work to be done in order to transform National Landing from a concept pitched on paper to a reality.

“It’s been long overdue for reinvestment of new and better amenities,” Kelly said.

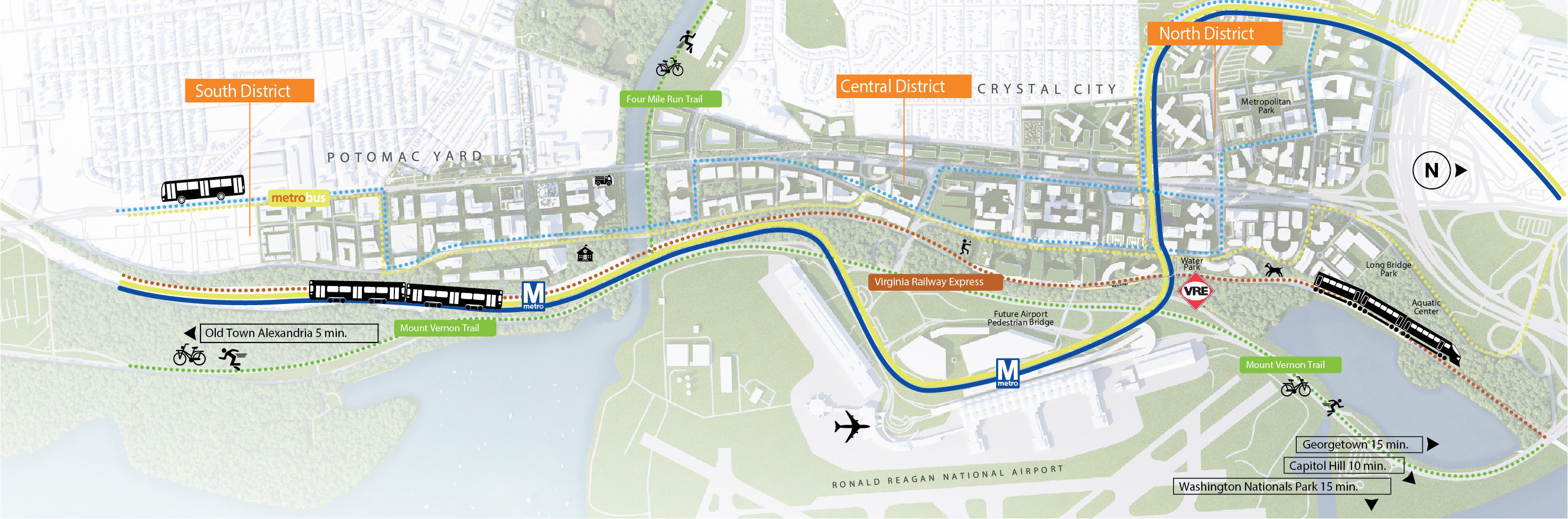

That’s exactly what JBG SMITH intended on doing, from developing lush green spaces to creating mixed-use construction in a walkable, sustainably built community. Then there’s the brand-new transportation system connecting Pentagon City, Crystal City, Alexandria, and Columbia Pike.

“Amazon gives us a real catalyst to do more and do it faster,” Kelly said.

In the near term, Amazon will be taking over space from three buildings that are largely vacant due to a federal government exodus from the area.

Kelly explained: “The way this unfolded was that Amazon had spent enough time with us that they knew we were easy to work with in that we were a group that knew how to get to ‘yes’ and how to make deals … Our approach is, ‘Let’s figure what our customer wants, and let’s just put a price on it …’ We find we get a better customer reception when we’re less rigid.”

Added Amazon’s Sullivan: “We wanted to choose a location where we could be successful as a company, but also needed to choose a location where our employees can thrive … a region of inclusivity and diversity.”

Check and check.

Soon enough, the pundits, handicappers, and data all arrived at the same conclusion: NOVA and New York would win the prize.

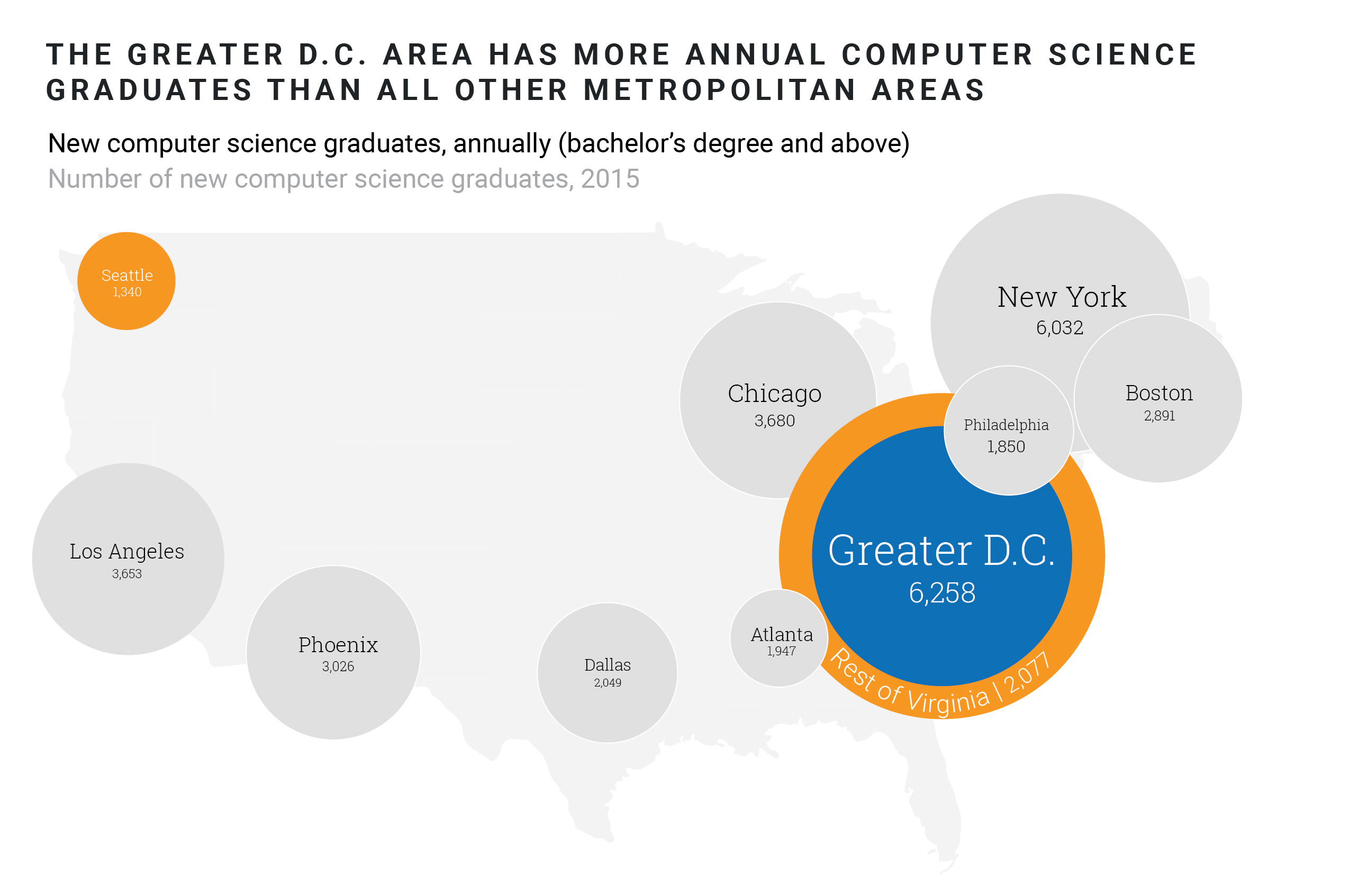

Its selection validated the choices Virginia made to dial up its tech talent. And now the entire Commonwealth stands to benefit from the doubling down on the pipeline in K-12 through higher education, as well as other benefits, from rural to urban areas.

“That was a lens that we all looked at this project through from the beginning,” Alexandria’s Landrum said. “It was why we were able to put in so much time and energy. We know it wasn’t just good for the region, but for the Commonwealth.”

Christina Winn, who worked alongside Victor Hoskins at the Arlington Economic Development Team as Director of the Business Investment Group, already saw the collaboration’s potential to generate future wins.

“The nice thing with the regional approach is that it created a template and gave us a great way to think about how we can work together moving forward,” she said.

Laying the Ground Work

In Crystal City, JBG SMITH had been working to consolidate real estate, amassing some 70 percent of the sub-market. This included acquiring some buildings just weeks before the HQ2 deal, with the goal of making it a place that residents will be proud to call home.

At Virginia Tech and other Commonwealth colleges and universities, education trailblazers have worked to create more holistic relationships with strategic industry partners to build tomorrow’s workforce. It’s no longer about internships here and financial contributions there; it’s about fleshing out robust, mutually beneficial relationships.

In Arlington and Alexandria, leaders have been seeking an opportunity to deploy a new economic development strategy informed by conversations within the community. This includes building on the areas’ approved 10-year Capital Improvement neighborhood sector plans, which for National Landing includes transit-oriented, walkable, mixed-use urban environments, as those plans envision considerably more growth than HQ2 requires.