Regional & Local Assistance

Virginia Enterprise Zone – Real Property Investment Grant

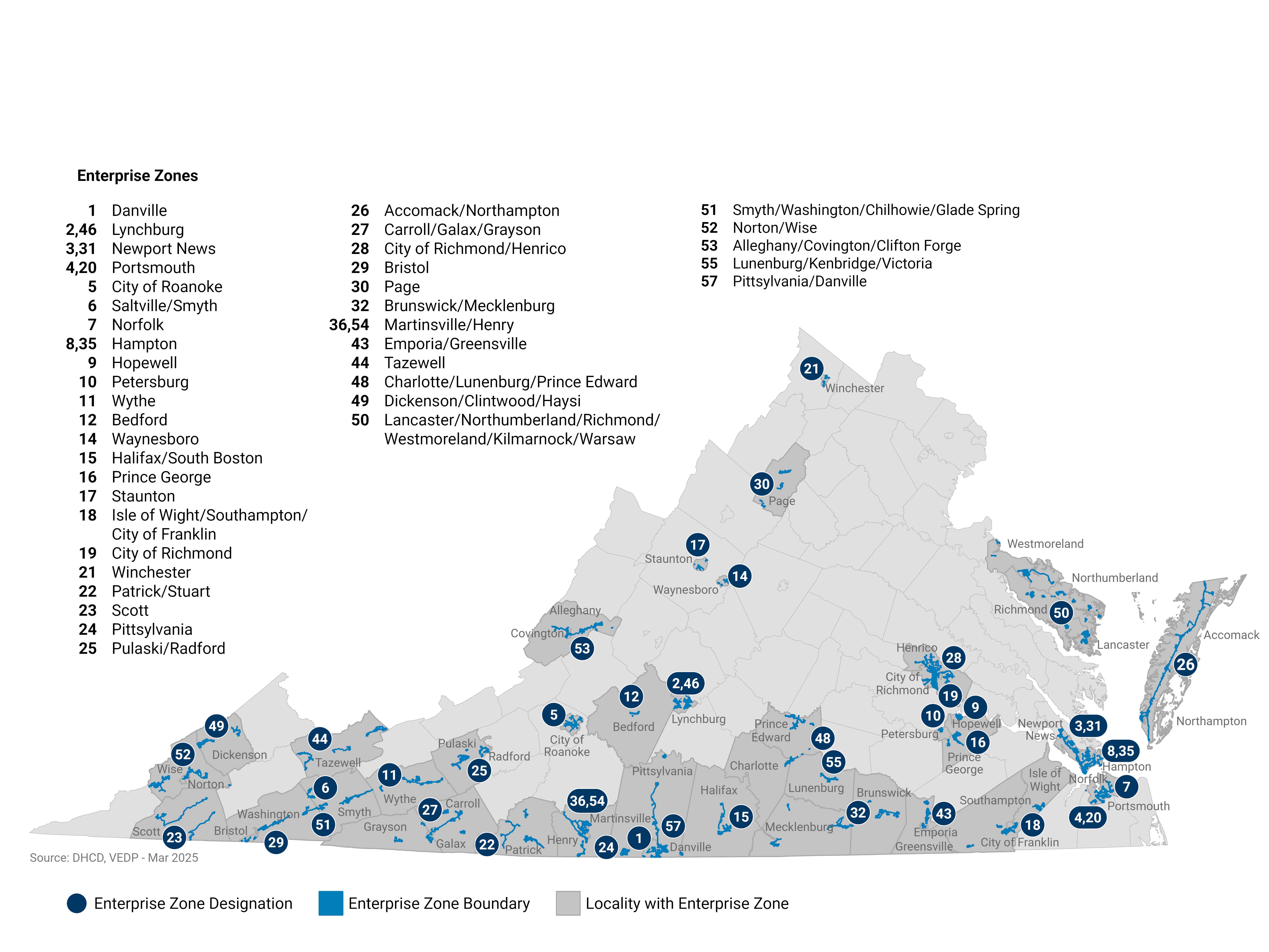

The Virginia Enterprise Zone (VEZ) program is a partnership between state and local government that encourages job creation and private investment. VEZ accomplishes this by designating Enterprise Zones throughout the state and providing two grant-based incentives, the Job Creation Grant (JCG) and the Real Property Investment Grant (RPIG), to qualified investors and job creators within those zones, while the locality provides local incentives.

Contact

Kate Pickett Irving & Mandy Archer Virginia Department of Housing and Community DevelopmentEligibility

Projects must meet the following eligibility requirements:

- The property must be located within the boundaries of a Virginia Enterprise Zone.

- The building or facility must be commercial, industrial, or mixed-use.

- “Mixed-use” is defined as a building incorporating residential uses in which a minimum of 30% of the usable floor space is devoted to commercial, office, or industrial use.

- For rehabilitation or expansion of an existing structure, the qualified zone investor must capitalize at least $100,000 in qualified real property investments.

- For new construction projects, the qualified zone investor must capitalize at least $500,000 in qualified real property investments.

- Investments in machinery and tools and business personal property are not considered real property and should not be included in RPIG calculations.

- For Solar:

- If the solar investment is more than $50,000, the threshold amount for the rehabilitation or expansion project is lowered to $50,000.

- If the solar investment is more than $50,000, the threshold amount for the new construction project is lowered to $450,000.

- If solar panels are the only investment made to the building/facility, the grant amount is calculated based on 20% of the amount made in solar installation; there is no threshold to be met.

- Applicant must be the entity that capitalizes the investment on their books for tax purposes.

- The investment used to apply for the grant must be taxed as real property by the locality in which the firm is located.

The following entities are prohibited from applying for the RPIG:

- Units of local, state, or federal government (typically FEIN 546)

- Any entity that does not capitalize the investment

Grants are awarded in five-year periods beginning with the first qualification year in which a grant was awarded for the subject building or facility. After the conclusion of a five-consecutive-year period, the property begins another eligibility period and the grant cap is restored.

By statute, Job Creation Grants (JCGs) receive funding priority over the Real Property Investment Grants (RPIGs). The remaining funding in the annual appropriation after JCGs are disbursed is then utilized to fund RPIGs. In grant years in which RPIG requests exceed the available appropriation, grants will be prorated. In the grant year 2020, grants were funded at a prorated amount of approximately 88 cents per dollar requested. In the grant year 2021, there was no proration and zone investors received the full amount for which they qualified.

Proration will be applied to the calculations below to calculate a company’s RPIG award.

- Grants are available in amounts up to 20% of the qualified real property investment OVER the respective eligibility threshold, capped based on the following limits:

- Grant awards are capped per building/ facility over a five-year term based on the cumulative level of investment starting with the qualification year in which a grant was first awarded.

- Grants may not exceed $100,000 per building or facility in a five-consecutive-year period where the total investment is less than $5 million.

- Grants may not exceed $200,000 per building or facility in a five-consecutive-year period where the total investment is $5 million or more.

- Grants may not exceed $300,000 per building or facility in a five-consecutive-year period where the total investment is $20 million or more.

Example Calculation 1

A company locates in a building within an Enterprise Zone and invests $500,000 in a renovation. After taking into account the $100,000 threshold for rehabilitation/expansion projects, the company could be eligible for up to $80,000 (subject to proration).

($500,000 – $100,000) x 20% = $80,000

Example Calculation 2

A company builds a new building within an Enterprise Zone and invests $6,000,000 in its construction. After taking into account the $500,000 threshold for rehabilitation/expansion projects, the company could be eligible for up to $200,000 (subject to proration). The calculation yields a higher number than the eligible award, but due to the $200,000 cap on projects over $5 million, that is the maximum award a company could achieve.

($6,000,000 – $500,000) x 20% = $1,100,000 cap exceeded

Maximum grant = $200,000

Example Calculation 3

A company builds a new building within an Enterprise Zone and invests $25,000,000 in its construction. After taking into account the $500,000 threshold for rehabilitation/expansion projects, the company could be eligible for up to $300,000 (subject to proration). The calculation yields a higher number than the eligible award, but due to the $300,000 cap on projects over $20 million, that is the maximum award a company could achieve.

($25,000,000 – $500,000) x 20% = $4,900,000 cap exceeded

Maximum grant = $300,000

Process

- The process is triggered when the final Placed in Service documentation is received (Calendar Year of Year 1).

- Qualification is determined when the supplemental forms, Zone Admin Signature, and CPA Attestation are received (January – March of Year 2).

- The company must submit applications electronically to DHCD by April 1. If April 1 falls on a weekend or holiday, applications are due the next business day (Year 2).

- DCHD reviews the application and notifies applicants by May 15 in cases where any additional information is required due to application deficiencies. Applicants must resolve any identified deficiencies by June 1 (April – June of Year 2).

- The funds are disbursed to the company (June of Year 2).

Resources

FAQ

If a company’s investment exceeds the amount needed to max out the award, must the company report all investments and have them attested to?

It is recommended. If the company is working toward the $5M threshold to unlock a second $100,000, then the company would need to have reported all expenses with the first application. If the company only reports $2M of a $4M project, it may not go back and report those additional expenses if it makes later investments that would put it over the $5M threshold. In addition, reporting the full QRPI allows DHCD to collect a more accurate picture of how much investment is being leveraged through the grants.

If a company received a CO in 2022, but some of the expenses were incurred in 2021. Are they eligible?

Grants and eligible expenses are based on the year of the Placed-In-Service documents, and not necessarily on the year of the expense. If the expenses incurred in 2021 contributed toward the project that received the CO in 2022, then the expenses may qualify.

If expenses were incurred in 2022, but the CO will be issued in 2023, can a company qualify for Grant Year 2022?

It may qualify, but not for grant year 2022. Applications must be submitted for the Grant Year in which they received their final Placed-In-Service documents. Therefore, the applicant in this example would need to apply for GY 2023 (applications accepted in 2024) after it receives the final Certificate of Occupancy or equivalent documentation.

If a company received invoices after they received their Certificate of Occupancy of Final Building Inspection, do the expenses qualify?

These expenses may still qualify. But the invoice documents should indicate the work was completed prior to the CO date, and the CPA should ensure these expenses meet all other qualifications.

What if a company received two COs on the same property in the same Calendar Year?

Expenses incurred under COs received in the same calendar year can be submitted on the same application. Expenses incurred under COs received in different calendar years may not, and will need to meet the threshold separately. Applications must always be submitted for the calendar year in which the Placed-In-Service documentation is received. Applications and expenses may not carry over into a later grant year.

What if a company received two COs on the different properties in the same calendar year?

Grant caps are based on the property, not the investor. An investor may qualify for a grant for more than one property in the same grant year.

What if a single investor owns multiple properties that are adjacent in a downtown area, and they are operated as separate buildings with separate tenants?

They would be considered separate buildings. Facility status is not only determined by proximity, but also by building use, management, and association.

What if an investor owns two adjacent properties that he is redeveloping into offices for a single company?

This would be considered a single facility, because the buildings are associated by management, use, and proximity. They are effectively being used as a single office facility.

Do parking decks qualify?

Yes, they are commercial.

Do hotels and bed & breakfasts qualify?

Yes, hotels do qualify. B&Bs can qualify so long as they are not in a residential home. If there is a permanent resident/innkeeper at the B&B, contact DHCD to discuss qualification.

Is Form EZ-RPIG-Multiple Owner required if the applicant is an entity that has multiple owners?

Most likely not. This form is required when the subject property is owned by multiple people or entities – not when the applicant (i.e., LLC) is owned by multiple people or entities.

What if a company constructed a new building at an existing facility?

This would be considered an expansion of the facility, not new construction.

What if a company demolished an existing building to rebuild?

This would most likely be considered new construction, unless a usable portion of the demolished building remained on the site.

Are architecture and engineering costs eligible?

These are considered soft costs and therefore are not eligible expenses – even when required by the locality.

How would utilizing Historic Tax Credits impact a company’s qualification?

HTCs are not mutually exclusive with RPIG. They do not impact the investor’s eligibility or otherwise eligible expenses.

Can the contractor on the project complete the third-party inspection?

The contractor on the project is not a third party due to their involvement. The locality will determine who can do the inspections, and it will typically be a Class A or B contractor.

If RPIG is prorated below 100%, can a company reapply to capture what’s remaining below the $100,000 cap?

Caps are based on funds received, not funds requested. Therefore, if the investor received $73,000 in Year 1. They would still be eligible for $27,000 between Years 2-5. However, they would need to re-qualify and meet the threshold with new expenses in Years 2-5.

Will awards be subject to proration?

It is possible that RPIG awards may be subject to proration during an application cycle. However, there has been no proration to the RPIG awards in Grant Years 2021, 2022, or 2023.

If you have additional questions, submit them to ezone [at] dhcd.virginia.gov (ezone[at]dhcd[dot]virginia[dot]gov).

Source: Virginia Department of Housing and Community Development