Regional & Local Assistance

Virginia Enterprise Zone – Job Creation Grant

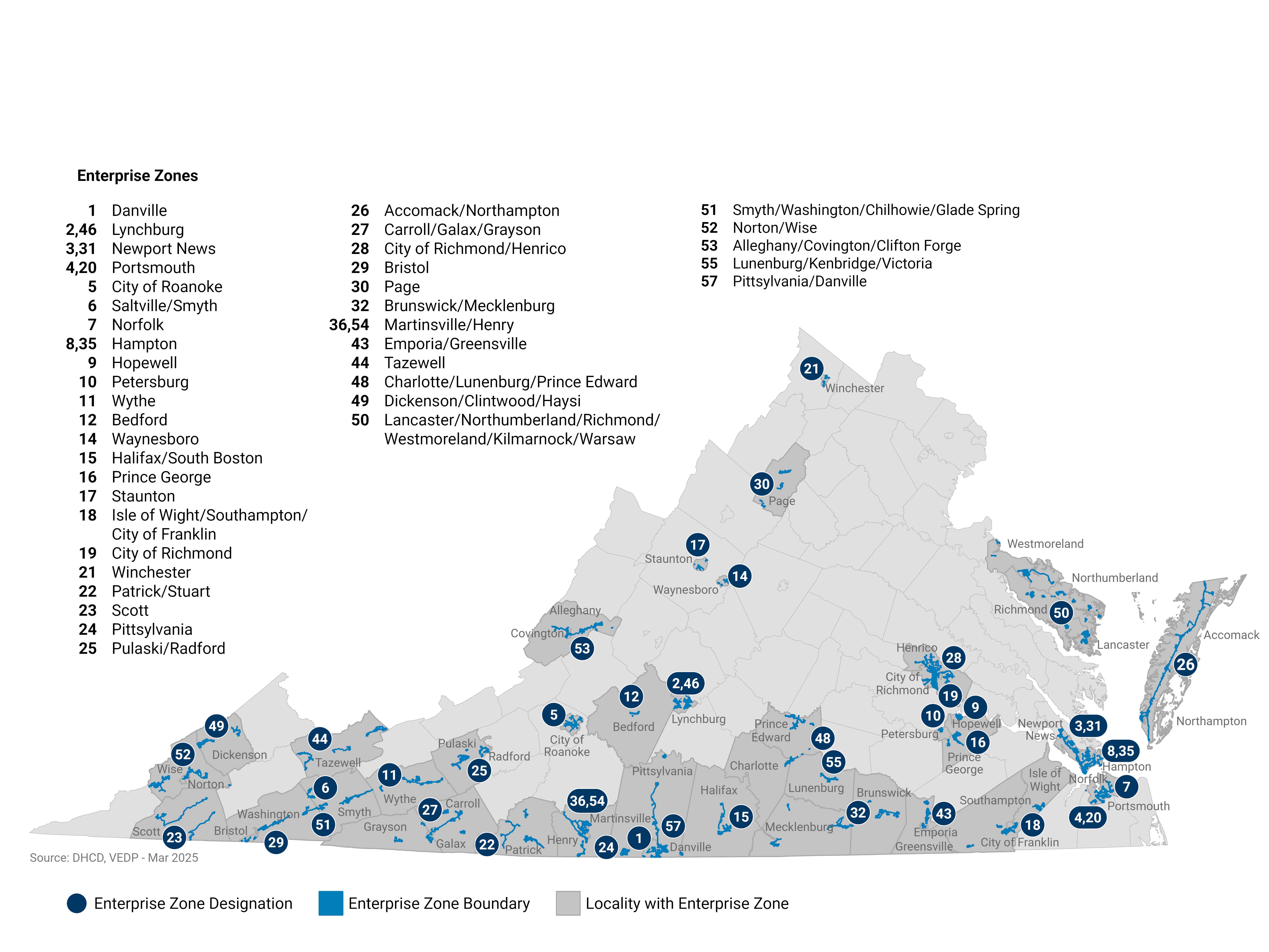

The Virginia Enterprise Zone (VEZ) program is a partnership between state and local government that encourages job creation and private investment. VEZ accomplishes this by designating Enterprise Zones throughout the state and providing two grant-based incentives, the Job Creation Grant (JCG) and the Real Property Investment Grant (RPIG), to qualified investors and job creators within those zones, while the local government provides local incentives.

Contact

Kate Pickett Irving & Mandy Archer Virginia Department of Housing and Community DevelopmentEligibility

All businesses must meet the following eligibility requirements:

- The business must be located within the boundaries of an active Virginia Enterprise Zone.

- The business must create at least four net, new permanent full-time positions over the base calendar year.

- Base-year employment can be either of the two calendar years immediately preceding the first grant year at the choice of the firm, whichever provides the most benefit to the company. Base-year employment is established in the first grant application and remains static for the full five-year period.

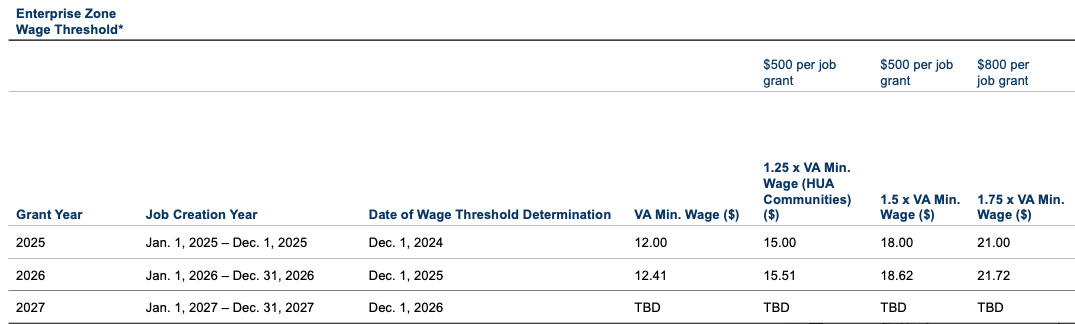

- These positions must meet wage and health benefit requirements. Positions must earn at least 150% of the minimum wage*, or 125% in for High Unemployment Areas (HUAs) and SWAM-certified businesses with an unemployment rate that is at least 150% of the state average.

- The firm must offer to cover at least 50% of an employee’s health insurance premium.

*After December 31, 2024, the Virginia Minimum Wage will increase annually based upon the Consumer Price Index. Adjustments to the Virginia Minimum Wage rate will continue annually by this same methodology and become effective January 1 of each year. The Enterprise Zone wage thresholds are determined on December 1 of the previous calendar year.

The following entities are prohibited from applying for the JCG:

- Units of local, state, or federal government

- Nonprofit, other than those classified as NAICS 813910 and 813920

- Personal service, food and beverage, and retail

The following positions are prohibited from being claimed for the JCG:

- Seasonal, temporary, leased, or contracted positions.

- Personal service, food and beverage, and retail positions.

- A person who previously qualified for a JCG in connection with a different Enterprise Zone location on behalf of the applicant taxpayer, a related job, or a trade or business under common control (i.e., cannot claim the same job twice).

- A person whose position previously qualified a firm for the Major Business Facility Tax Credit.

Grants are awarded in five-year periods beginning with the first grant year in which a JCG was awarded.

- To be eligible for the JCG in years two through five, the firm must maintain or increase the number of eligible permanent full-time positions (above the four-job threshold) over base year employment.

- Firms may apply for a subsequent five-year period given they meet the grant eligibility requirements.

JCG awards are determined by the wages paid and the number of full months that positions were filled during the grant year.

Grants are available in amounts of:

- Up to $500 annually per grant eligible position filled by an employee earning at least 150% (125% in HUAs and SWAM-certified businesses) of the minimum wage*, who was offered health benefits.

- Up to $800 annually per grant eligible position filled by an employee earning 175% of the minimum wage* who was offered health benefits.

*"Minimum wage" means the federal minimum wage or the Virginia minimum wage, whichever is higher. The Department shall determine whichever is higher for the current calendar year as of December 1 of the prior calendar year, and its determination shall be continuously in effect throughout the calendar year, regardless of changes to the federal minimum wage or the Virginia minimum wage during that year.

Firms can receive grants for up to 350 positions per year.

Job Creation Grants have funding priority among Enterprise Zone grant applications.

Process

- The company triggers the process by achieving net new employment over the base year and eligibility threshold (Calendar Year of Year 1).

- Qualification is determined when the JCG Worksheet and CPA Attestation are received (January – March of Year 2).

- The company must submit applications electronically to DHCD via the Enterprise Zone Application Submission System by April 1. If April 1 falls on a weekend or holiday, applications are due the next business day (Year 2).

- DCHD reviews the application and notifies applicants by May 15 in cases where any additional information is required due to application deficiencies. Applicants must resolve any identified deficiencies by June 1 (April – June of Year 2).

- The funds are disbursed to the company (June of Year 2).

Resources

FAQ

Is a brewery excluded from JCGs as a “Food & Beverage Service”?

Any positions at the brewery that work in an on-site restaurant or tasting room would be excluded. Positions that work in the manufacturing and distribution capacities would be eligible.

Is “incentive pay” included in the wage-rate calculation?

The proposed scenario referred to a company where employees were paid a base wage plus “daily incentive pay” based on the number of “widgets” produced each day. This incentive pay is effectively a bonus and, therefore, cannot be included in the wage-rate calculations for the Job Creation Grant; only base wages are eligible. Bonuses and overtime are excluded from JCG calculations. Commissions and shift premiums are included.

Does a three-month waiting period for health coverage disqualify that position from eligibility?

No, so long as that position meets the other eligibility requirements and would be offered health insurance at the end of the three-month probationary period.

How does zone expiration impact company eligibility?

If a business qualified for Year 1 of JCG before the zone expired, they may complete their five-year term. However, they may not qualify for a subsequent five-year term. RPIGs do not carry over.

If the applicant is exempt from the attestation, what needs to be submitted with Form EZ-JCG?

If a business is exempt from the CPA attestation because of its size, then the company is required to submit the JCG Worksheet (both tab 1 and tab 2) with its electronic application.

Is there an e-signature option?

Electronic signatures ARE accepted for EZ grant applications.

Do you still require hardcopies to be mailed in?

Hardcopies are NOT accepted. Only electronic submissions are accepted.

If you have additional questions, submit them to ezone [at] dhcd.virginia.gov (ezone[at]dhcd[dot]virginia[dot]gov).

Source: Virginia Department of Housing and Community Development