Tax Incentives

Major Business Facility Job Tax Credit

Qualified companies locating or expanding in Virginia are eligible to receive a $1,000 income tax credit for each new full-time job created over a threshold number of jobs beginning in the first taxable year following the taxable year in which the major business facility commenced or expanded its operations.

Eligibility

- The company must be engaged in business in Virginia.

- Retail trade businesses do not qualify for the credit.

- The company must create net, new full-time jobs in excess of the threshold number specific to the locality.

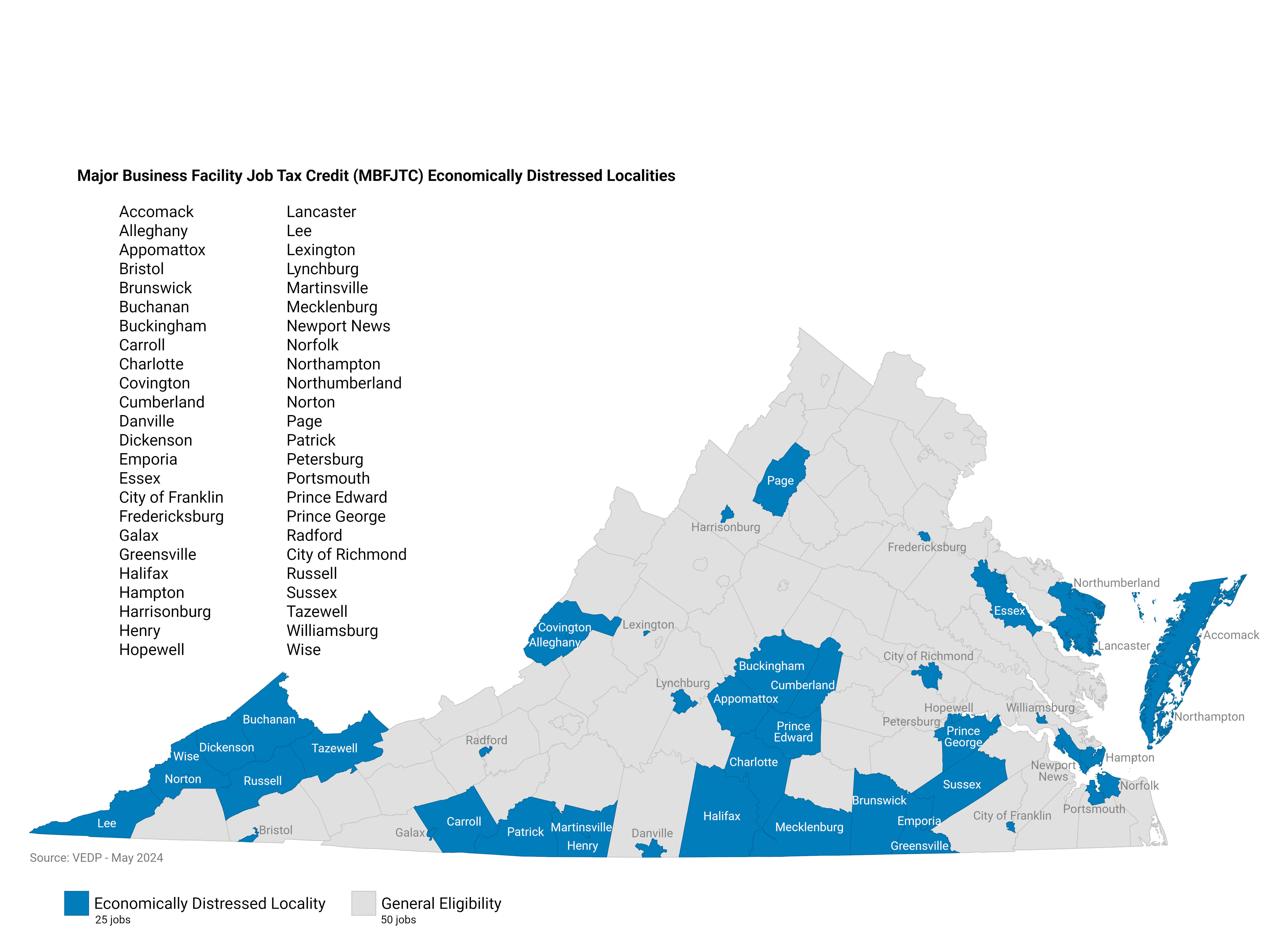

- The qualifying threshold number is 50 new jobs for the establishment or expansion of a major business facility in Virginia.

- The qualifying threshold number is 25 new jobs for the establishment or expansion of a major business facility in a locality identified by the Virginia Economic Development Partnership as an economically distressed area or located within an active Enterprise Zone.

- Credits are subject to recapture if employment decreases during the five years following the credit year.

- The threshold number of jobs must be created within a 12-month period.

- Only new full-time employees are eligible for this credit.

- Non-qualifying jobs include seasonal or temporary jobs, positions in building and grounds maintenance, security, positions ancillary to the principal activities of the facility, and/or a job created when a position is shifted from an existing location within the Commonwealth to the new major business facility.

- For jobs on the payroll for less than the full calendar year, the credit will be prorated.

- Credits are available for taxable years before July 1, 2025. Unused credits may be carried over for up to ten years.

Credit windows range from 24- to 35-month time periods depending on the company’s tax year. Credits are taken in equal installments over two years ($500/year).

Companies may not claim the same jobs for the Major Business Facility Job Tax Credit, the Enterprise Zone Job Creation Grant, the Port of Virginia Economic and Infrastructure Development Grant, the International Trade Facility Tax Credit, or the Green Job Creation Tax Credit.

Process

- Corporate filers must complete Form 500CR, Part X to claim the Major Business Facility Job Tax Credit.

- Taxpayers submit Form 304 90 days before filing a tax return. This credit requires certification from the Tax Credit Unit to be claimed on the tax return.

- The Virginia Department of Taxation sends the taxpayer a letter to certify the credit.

Resources

FAQ

Can the allowable credit exceed a company’s tax liability?

No, the allowable credit may not exceed the company’s tax liability.

Can two part-time employees be combined to qualify as one “equivalent” full-time employee?

Yes, the hours of two part-time employees may be combined to qualify as one full-time employee, as long as the combined number of hours worked meets the requirements. The combined number of hours worked must be equal to or greater than 35 hours per week for the entire year, or 35 hours per week for the portion of the taxable year in which the employees were initially hired for, or transferred to, the facility in Virginia.

Can a contractor or subcontractor qualify as an eligible employee?

Yes, if they are permanently assigned to the taxpayer’s major business facility. The taxpayer must be able to provide evidence to the Department of a contractual agreement with the contractor or subcontractor prohibiting the contractor or subcontractor from also claiming these employees in order to receive a credit under this section.

What information is needed for each employee in order to complete Form 304?

The following information will be needed for each eligible employee: name, date of hire, Social Security number, number of full months employed during the credit year, brief position description, and the number of hours worked per week.

Who may claim the Major Business Facility Job Tax Credit?

Individuals, estates, trusts, corporations, banks, insurance companies, and telecommunications companies may claim Major Business Facility Job Tax Credits for qualified job expansion in excess of the threshold amounts.

Where must applications for the tax credit be sent?

All applications must be sent to:

Virginia Department of Taxation

Tax Credit Unit

P.O. Box 715

Richmond, VA 23218-0715